- An increasing body of research indicates that investing with input from ESG data offers meaningful possible benefits to performance.

- Despite its potential for reducing risk and enhancing return, ESG data remains remarkably underutilized by most investors.

- We can enhance the utility of ESG data with thoughtful fundamental research, reflecting deep understanding of the context for different companies and industries.

Demand for ESG (environmental, social, and governance) investment strategies is growing, and as sustainable investing approaches develop, our understanding of ESG data is also evolving. Some view the ESG field with skepticism and wonder whether studies showing its benefits are incomplete. Meanwhile, some sustainable investing enthusiasts may put too much faith in using ESG data alone to identify investment opportunities.

Combining fundamentals with ESG factors holds promise

Evidence shows — no surprise — that reality lies somewhere in the middle. ESG investment data is useful, yet is still improving in volume, quality, and relevance. For example, a large portion of ESG research assesses corporate policies rather than performance. Additionally, ESG data is sometimes compiled without a robust fundamental understanding of the context in which a company operates. We believe that incorporating ESG ratings into an investment process must be accompanied by a commitment to high-quality fundamental analysis.

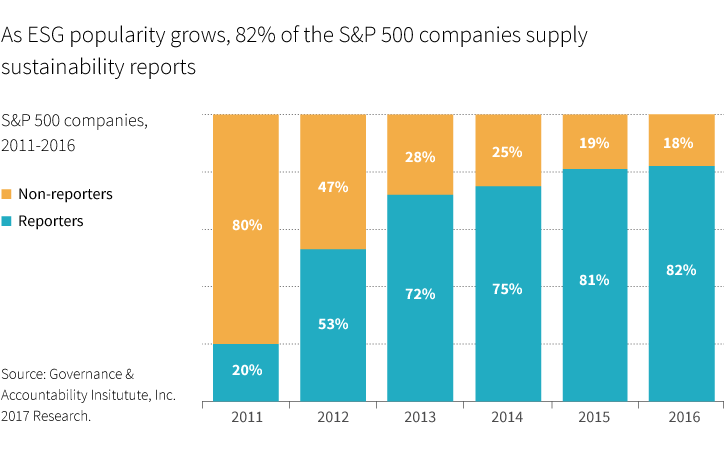

Curiously, ESG data remains underutilized by many investors, despite rising interest in the field and its intriguing investment potential. The importance of ESG fluency is clear, as sustainability reporting is becoming standard for companies worldwide.

Consider some findings from recent empirical studies relating to ESG data and sustainable investing approaches:

- Product-based exclusionary screens (no guns, tobacco, etc.) fulfill values and mission orientation for some investors, and are often modest drags on performance when considered in isolation.

- More complex inclusionary investment processes (overweighting good ESG performance) have potential to add alpha, but require fundamental understanding to be effective.

- ESG awareness can also help mitigate bankruptcy and performance risk.

For all investors, having higher ESG fluency holds the potential to improve both risk and return. For sustainability-focused strategies, it’s possible to achieve both strong financial performance and strong ESG performance — not either/or.

How fundamental research can contribute

What’s more, active, fundamental asset managers have a unique opportunity to contribute to the progress of sustainable investing. Analysts who already have deep knowledge of companies and industries can provide the contextual understanding that ESG data may lack; they can assess the relevance of ESG data to each company’s operations. Integrating ESG factors with fundamental research creates a more robust foundation for building investment portfolios.

308267

More in: Sustainable investing