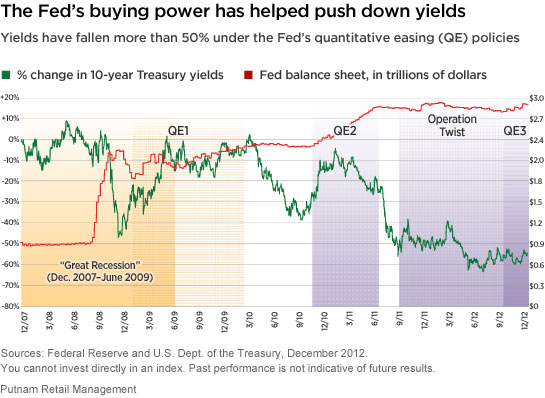

There is little question that interest rates would be significantly higher in the absence of Fed purchases.

It is important to understand how potentially damaging a long-duration strategy could be in this environment.

The duration, or sensitivity to rate movements, of a 10-year Treasury bond is about nine years, which means that an increase in rates of just 100 basis points would result in an approximate 9% drop in the value of that bond.

For investors purchasing bonds outright who are willing to hold their positions until maturity, that may not be a concern. But investors with broadly diversified portfolios who need even a moderate degree of liquidity should be mindful of their duration exposure in this environment.

More in: Fixed income, Outlook