- Multiple studies show that Americans are broadly unprepared financially for retirement.

- A successful retirement savings plan combines informed investor behavior with optimal plan design and

investment options. - It is important to consider investment needs across the participant population.

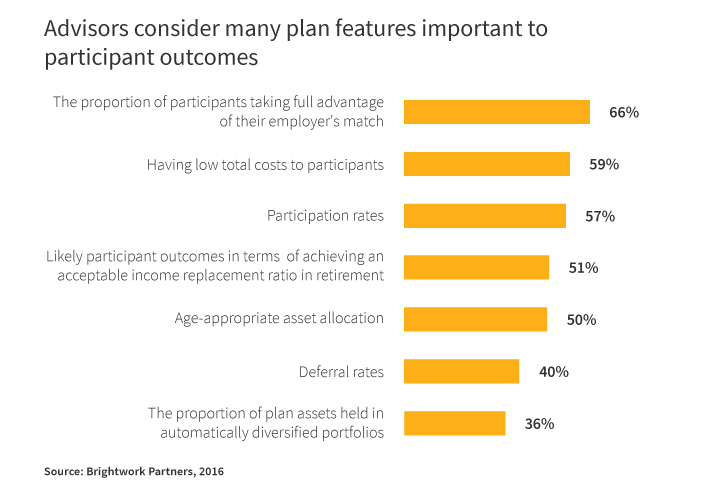

A growing number of advisors cite participant outcomes that are reflected by income replacement in retirement as an important measure of retirement plan effectiveness.*

Outcomes are the consequence of more than just investment returns. Plan features including auto enrollment, auto-increase, employer match, participant deferral rates, and investor education all work together to drive improved participation, savings rates, and ultimately accumulation of retirement assets.

The importance of saving adequately

Future retirees must set savings goals, make the necessary savings to replace working income in retirement, and take responsibility for selecting a process aimed at maximizing results by both growing and later preserving retirement assets. If investors do not save enough during their working years, chances of a positive outcome are slim. The higher the savings rate, the higher the probability of success.

Auto features and education play critical roles

Plan advisors and sponsors must work together to consider the age demographics and salary ranges of the participant population to design a plan that can fit the needs of a range of participants. This begins with investment education and incentives for maximizing participant contributions including making enrollment and investment decisions easy.

Auto enrollment, a company match, and automatic increases in deferral rates are all factors in improving the chances that participants reach their retirement savings goals.

Target-date funds are a compelling investment option

The other critical piece of plan design is having investments that complement needs across the participant demographic. Target-date funds resolve this issue by providing professional, disciplined, risk-managed investing based on where the participant is on the glide path to retirement. When participants have long time horizons, the primary goal is to accumulate wealth by investing aggressively and maximizing savings. Glide paths maximize growth potential at the accumulation phase. As participants get closer to retirement, the need for accumulation is increasingly balanced by the need to preserve assets. Target-date funds can manage this process seamlessly for participants.

Plan sponsors also see benefits

A primary benefit for plan sponsors is that employees who save enough are able to retire on schedule, which may also decrease costs for employers, more than making up for increased plan costs. Giving participants the education and investments they need to be successful can increase positive outcomes across the board.

* Study by Brightwork Partners LLC, 2016.

308330

More in: Retirement