According to Commerce Department data released in late June, there were 233,000 new homes sold in the first five months of this year — a 24% increase from the same period a year earlier. However, builders still have ground to make up. Even with this spring’s sales surge, the market pace of sales in May — 546,000 homes annually, when seasonally adjusted — amounts to roughly 75% of the average annual pace from 2000 to 2014. In our view, there needs to be roughly 1.2 million to 1.5 million new homes available each year to support normal population growth.

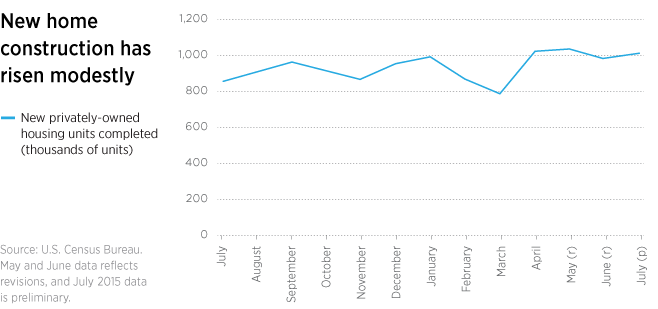

Construction has not kept pace

We’re currently not building enough homes in the United States to keep pace with new households, creating an imbalance between supply and demand. While home prices continue to appreciate moderately, housing affordability is somewhat better than it was two years ago. With an improving employment backdrop, continued low mortgage rates, and modestly easier mortgage-lending standards, we think demand-side fundamentals are positive. As a result, we believe new-home construction may continue to accelerate in the months ahead.

The impact on prepayment activity

More construction means more mortgage debt, which is another reason to like prepayment risk. New regulations cause some concern about prepayment risk, but this concern is offset by the prospect of higher rates. Currently we are monitoring a new Federal Housing Administration policy that reduces the mortgage insurance premiums charged to certain borrowers. This policy could accelerate refinancing to some extent. However, we believe it is unlikely to have a major impact on the overall pace of residential refinancing. We continue to find prepayment risk attractive, given the likelihood of higher interest rates as the U.S. economic recovery matures.

296764

More in: Fixed income