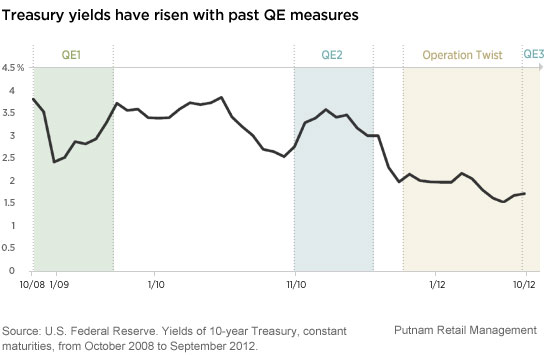

The Fed has taken extraordinary measures since 2008 to help keep long-term interest rates low through two rounds of quantitative easing, known as “Operation Twist,” followed by a third round of easing that targets the mortgage-backed securities market. “QE,” as it’s typically known, is essentially a bond-buying program designed to introduce higher demand into the bond markets, driving prices up and yields down.

While that may be the intent, in the months after QE1 and QE2 were announced, long-dated Treasuries actually saw their yields rise. Investors understand that these forms of market stimulus are on some level inflationary, and we believe the greatest potential cause of a significant rise in long-term interest rates would be if investors came to believe that the flow of federal stimulus was being wound down too quickly for other market participants to pick up the slack in demand.

More in: Fixed income, Outlook