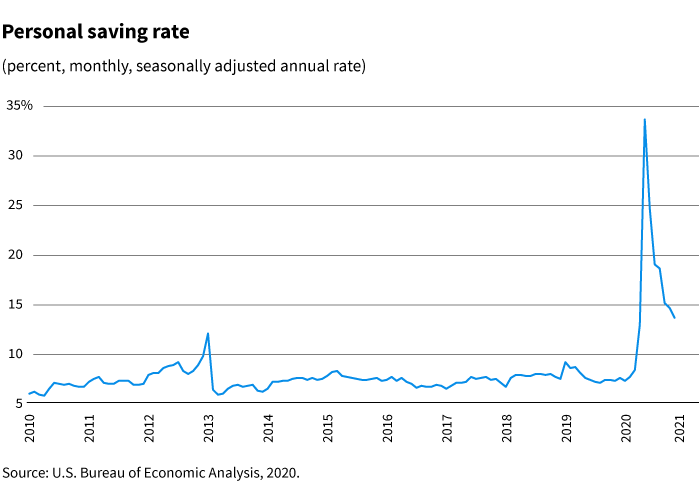

- The nation’s personal savings rate reached a record high during the pandemic.

- Individuals working remote are staying home more and spending less.

- Plan sponsors may want to optimize auto features to make it easier for savers to direct money to retirement plans.

The COVID-19 pandemic upended consumer behavior, with the unexpected result that workers for a time saved more than ever before.

Aside from the effects of the virus, many workers lost jobs and faced new medical expenses. On the other hand, government aid replenished some lost income. And with lockdowns and concerns about the surging number of virus cases, more people have worked remotely, stayed at home, and spent less money.

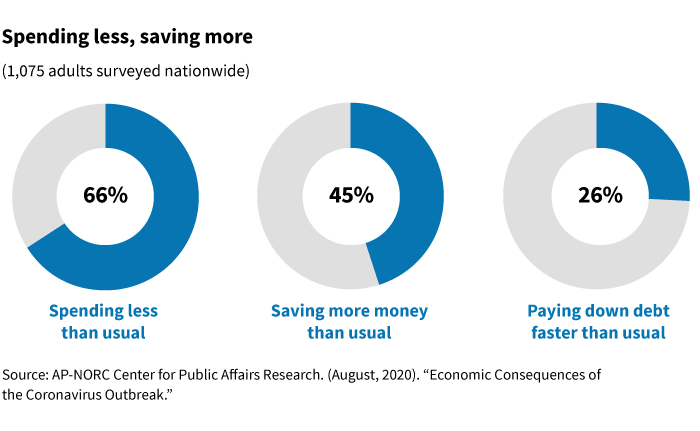

Without commuting, dining out, or shopping in brick and mortar stores, some workers are finding they have money to set aside. Recent surveys discovered that many individuals are using those funds to pay down debt or add to savings accounts.

Still, millions of workers who have lost their jobs find it difficult to save money. The enhanced unemployment benefit of $600 per week under the CARES Act expired in July. An extension to 39 weeks and aid for self-employed workers expired at the end of 2020. Congress’ new relief package for early 2021 is less generous.

Savings rate soars for some

Many individuals chose to save more. The nation’s average personal saving rate briefly reached a record high of 33.7% in April, according to the Bureau of Economic Analysis. The rate more than doubled from the 12.9% recorded in March. In October, the saving rate remained elevated at 13.6%.

New outlook for budgeting

In addition, workers have been paying down debt at a faster rate. A recent survey (AP-NORC) observed these trends among more than half of respondents, including full-time workers as well as individuals who have lost at least some of their income during the pandemic. Two thirds of respondents (66%) are spending less. The survey found that 45% of individuals are adding to savings, and 26% are paying down debt including credit card, car, medical, or college debt.

Auto features can help savers add to retirement savings

Behavioral science and industry research have shown that retirement plans with automatic features engage workers and help them commit to regular savings.

The pandemic has caused workers to focus on saving what they otherwise would be spending. This may be a good time for plan sponsors to optimize features and guide workers to think about using their workplace retirement plan more strategically.

More sponsors are adopting auto features

In 2019, 69% of plans used auto enrollment. This is up from 60% in 2016, based on the Defined Contribution Institutional Investment Association 2020 survey. Both large and small plans joined the trend. Use of auto-escalation of savings has also been on the rise. Today, 69% of plans offer it, up from 50% in 2016. Larger plans (76%) are more likely than smaller plans (55%) to offer it. Among plan sponsors, 60% offer this feature as a default along with auto-enrollment. The remaining one-third report that participants must choose to opt in.

Analyze plan design

Plan sponsors may encourage workers with extra cash to allocate some of their savings to retirement. An auto-enrollment feature can help nudge employees into saving. Auto-escalation helps savers by increasing deferral rates over time. In fact, a recent Empower-Retirement study found that auto escalation had a more significant impact on retirement readiness than auto-enrollment.

Plan sponsors considering making changes to their plans can find tools to help. Examples include Putnam’s PlanVisualizerTM for advisors. This plan design optimization software may be used to help sponsors think strategically about their 401(k) plans. In a few minutes, the tool analyzes data to measure the impact of design changes on plan success and cost. The measure of success is the degree of income replacement. PlanVisualizerTM can assess whether a plan is on track to replace needed income for a significant number of participants. Many retirement plan specialists have found the interactive nature of PlanVisualizerTM has provided enhancement to webinar based client and prospect meetings.

By adopting a data-driven approach, plan sponsors can begin to make design decisions that have measurable, positive outcomes for plan participants. As participants continue to adjust their spending and saving to the pandemic and post-pandemic conditions, it’s important to keep sight of future retirement needs.

324145

More in: