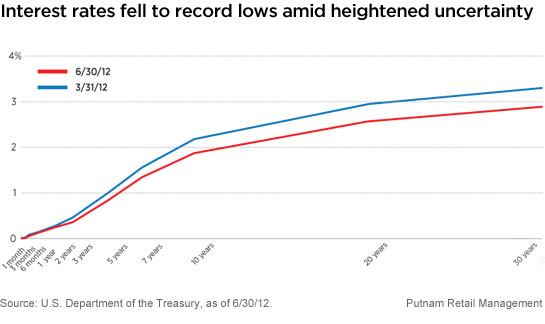

Despite the uncertain macroeconomic environment, we continue to believe that a strategy that relies on rates declining further to drive returns is a risky proposition. At current levels, interest rates would not have to increase much in order for investors to start seeing price declines in Treasuries and certain other high-quality bonds that today offer little income to offset negative price movements. Although the uncertain macroeconomic environment has led us to reduce risk profiles in our portfolios, we have maintained our bias in favor of credit risk and, to a lesser degree, prepayment risk over interest-rate exposure.

Read the entire Fixed Income Outlook.

More in: Fixed income, Outlook