- While interest in sustainable investing is rising, many individuals have not yet taken action to integrate sustainability into their investment decisions

- Investors have a range of choices for their portfolios, from simple exclusionary strategies to impact investing that looks “beyond sustainability”

- As the sustainable investing landscape continues to evolve, investors should see more ways to match their own priorities with relevant investment options

Investor interest in sustainable investing has been rising steadily: A survey from Morgan Stanley’s Institute for Sustainable Investing (“Millennials Drive Growth in Sustainable Investing,” August, 2017) showed that 75% of individuals are interested in this evolving investment style. Among Millennials, the figure was even higher — 86%. However, only about half of interested investors have taken action to integrate sustainability into their investment decisions. Why the disconnect between interest and action? One reason is that sustainable investing, like all investing, is offered in a range of different styles and products, which can make navigating choices a challenge.

Navigating an evolving environment

Once some basic distinctions are clear, it becomes easier for investors to find the approach that may match their own objectives and interests. Here is a quick tour of sustainable investing approaches:

Exclusionary approach: Some investors focus mainly on what should NOT be part of their portfolios. For example, recently there has been growing interest in fossil-fuel-free strategies or approaches that exclude gun manufacturers. These exclusion-only strategies can satisfy specific preferences, but investors should be thoughtful about assessing any portfolio shifts that might occur as a result of the exclusions.

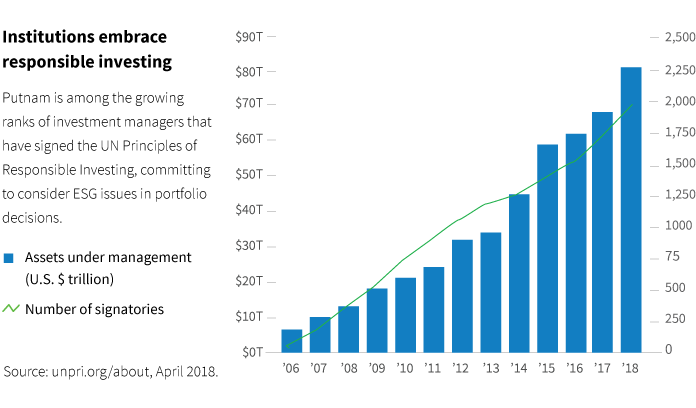

Integrated approach: For many investors, sustainability is a common-sense consideration. As issues like water supply, diversity, and corporate governance become more relevant to the fundamental business of companies, they are naturally of greater concern to investors, too. Integrated approaches tend to make use of the growing body of ESG data (environmental, social, and governance), and at Putnam we believe it is essential to use this data in its relevant, industry-specific context. Since our investment process focuses on deep fundamental research, it’s especially well suited for this kind of integrated approach. Many of our existing portfolios incorporate some level of integrated analysis.

Impact approach: For some investors, the goal is “beyond sustainability.” They want to invest in companies that are actively solving some of our biggest challenges through innovative products and services. Impact investing typically involves setting explicit goals for both financial return and social or environmental benefit. Although this is now a fairly common approach in private markets, the characteristics of impact investing for public securities are still evolving. At Putnam, we see potential to use our fundamental research strength to identify innovative companies that are at the forefront of addressing unmet needs and solving pressing challenges.

As the sustainable investing landscape continues to evolve, investors should see more ways to match their own priorities with relevant investment options. At Putnam, we believe we have already benefitted from using ESG data and sustainability analysis in our company research, and this analytical focus has the potential to benefit investors, our communities, and our planet for many years to come.

311876

More in: Equity, Sustainable investing,