Alternative investments have been among the fastest growing areas of the investment industry over the past decade. However, the sector’s nomenclature still reflects its hedge fund lineage, with opaque names such as “long/short” more prevalent than easy-to-grasp terms such as “growth.”

The viewpoint of investors

The world of alternative investments may seem more exotic and difficult to navigate in part because of the terminology. Alternatives can offer benefits to all kinds of investors who want to diversify their portfolios for specific purposes, such as to reduce volatility. It’s important to have a better roadmap.

Four important groups

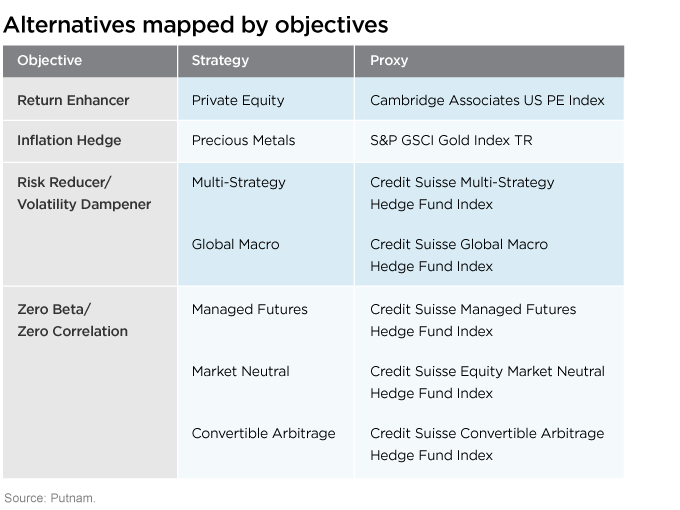

As part of our recent research comparing the performance of different types of alternative investment strategies over multiple economic scenarios of the past 20 years, we endeavored to classify groups of alternative strategies and develop more descriptive labels for them. We mapped strategies into categories to provide a goal-based approach to understand the types of roles they may play in a portfolio, as a way for investors to better understand the possible uses for each one.

We see four primary objectives for alternatives.

• Return Enhancer Seeks to outperform traditional equity, fixed-income, or mixed-asset strategies.

• Inflation Hedge Seeks to preserve capital and purchasing power over time and especially in periods of increased inflation, when traditional financial assets may lose purchasing power.

• Risk Reducer/Volatility Dampener Seeks to pursue efficient return streams with an emphasis on reducing the risk of market drawdowns as well as long-term volatility.

• Zero Beta/Zero Correlation Seeks to provide return that is completely independent from traditional asset classes.

Aligning objectives with strategies

After focusing our attention on better describing these four potential benefits that alternatives can offer to portfolios, we looked at the variety of strategies that could fit these objectives.

We found that, in a few cases, different alternative strategies could fall under the same objective. For example, a multi-strategy approach and a global macro approach both offer ways to reduce risk or dampen volatility. Similarly, managed futures, market neutral, and convertible arbitrage strategies try, in different ways, to reduce portfolio beta and market correlation.

We then identified indexes that could be used as proxies to analyze the performance of alternative objectives over time.

Viewing alternatives through the prism of what they can actually do for investors helps to dispel some of their complexity, we believe. The four objectives that we have identified, like the efforts of rating agencies such as Morningstar and Lipper to define categories for comparative purposes, help to make the world of alternatives a little easier to navigate.

The objectives also provide the framework for our research paper for financial professionals, Alternatives in Action, which studies the performance of alternatives in different economic scenarios of the past 20 years.

298434

More in: Asset allocation