The Fed’s much-anticipated interest-rate hike will probably come without warning, despite efforts by analysts and investors to estimate its timing.

During its April meeting, the FOMC discussed the possibility of delivering a “warning” before the liftoff, but most of the committee opposed the idea.

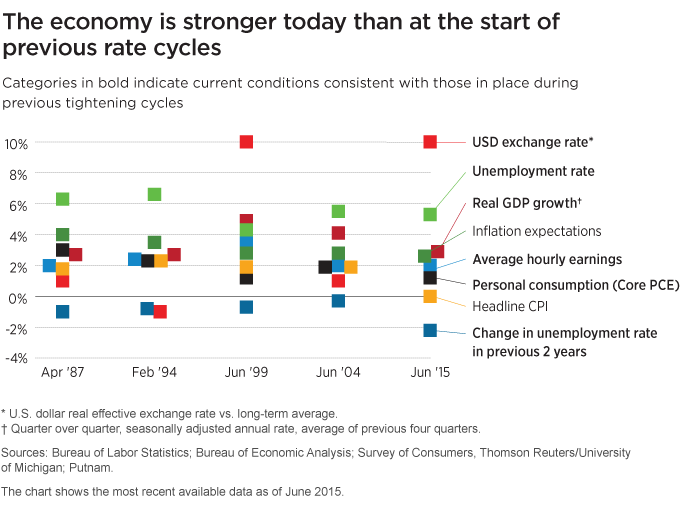

In addition, a warning is unlikely because there are no “typical conditions” for the start of a rate hike. An analysis of conditions in place at the beginning of previous tightening cycles illustrates that there is no clear-cut trigger along any of the dimensions of the Fed’s dual mandate. It’s also important to note that the current recovery is firmly established and several metrics are far beyond the point at which previous rate hikes have begun.

Reading “data dependency”

The Fed stated that its strategy depends on incoming data. Using this as our guide, we think it’s likely that the first rate increase will be implemented in September, as core inflation re-emerges. If the economy continues on its trajectory, we believe the Fed could hike rates a second time before year-end.

There are factors that could slow this pace. Weaker-than-expected employment and consumer spending data could stay the Fed’s hand. Renewed dollar strength could also cause the Fed to delay, since a stronger dollar would make U.S. exports less competitive and dampen the profits of multinational companies, potentially hampering growth.

Still, we think the Fed will proceed cautiously in an effort to avoid causing excessive volatility in the financial markets.

296348

More in: Outlook