U.S. large caps over the past several years have embraced again a traditional way of rewarding shareholders through dividend increases.

When a company raises its dividend payout, or begins to pay a dividend, it’s a sign of confidence in its future business prospects. During the U.S. economic recovery that began in 2009, many corporations have placed an emphasis on trimming expenses. Such moves put them in a better position to support dividends to shareholders.

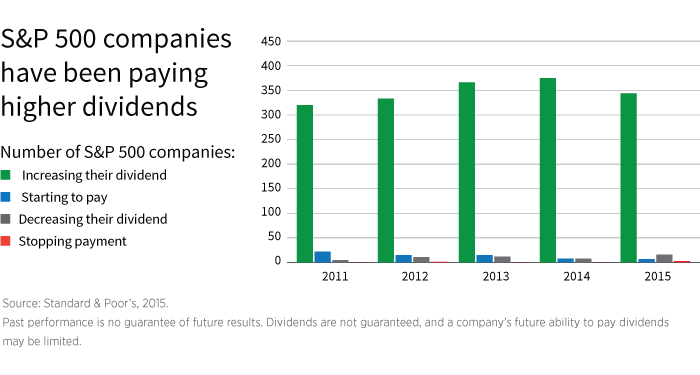

A majority of the companies in the S&P 500 Index have increased their dividend each year for several years running. This number peaked in 2014, then dropped modestly in 2015.

Last year also saw a small increase in the number of companies that decreased or stopped paying a dividend, reflecting in part the stress on revenues that occurred for many companies in the energy sector as oil prices plunged. The S&P 500 Index also had its weakest year of performance in 2015 since 2008.

Although dividends are often less noticed than changes in stock prices, historically they contribute significantly to the total return of stocks to investors. And if a low return environment persists, dividends could matter even more in the future.

300301

More in: Equity