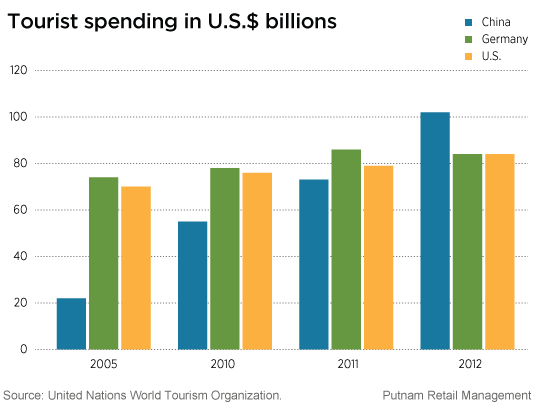

Tourists from China spent more money abroad in 2012 than tourists from any other country. At US$102 billion, Chinese international tourism eclipsed — by 20% — the total amount spent by either German or U.S. tourists.

Only seven years earlier, China spent less than one-third of what these two countries spent on travel. As massive savers, avid international travelers, and brand-name-focused shoppers, Chinese consumers are finding they can afford to spend prolifically while abroad.

Shopping is a priority for emerging-market tourists

As Putnam analyst Sarah Marshall reports in a recent Putnam Perspective, at least half of Chinese luxury spending happens outside mainland China. When the Chinese travel internationally, they are not only interested in taking in the sights — they also want to acquire otherwise hard-to-get goods. Alongside the Tower of London and Buckingham Palace, Bicester Village, a designer outlet shopping center in the countryside north of London, is one of the most popular U.K.-based destinations visited by Chinese tourists.

Rising disposable incomes enhance tourism-related investment themes

In the face of such rapid growth in Asian consumer strength, the global tourism industry is being transformed. In South Korea, for example, we see a shift in the pattern of consumption away from luxury retail and toward the travel and gaming industries.

Disposable incomes are rising in China and elsewhere in the emerging world, and the opportunities for attractive investments in tourism-related themes, from luxury European markets to leisure and gambling concerns in Korea and Macau, is growing accordingly.

285415

More in: Equity, Global sector