- We expect the U.S. economic recovery likely to be uneven as coronavirus health risks cast a shadow on demand.

- Q2 contraction will be one for the record books since the economy has been in pause mode to contain the pandemic.

- Bailouts to keep businesses afloat raise questions about the public sector’s role.

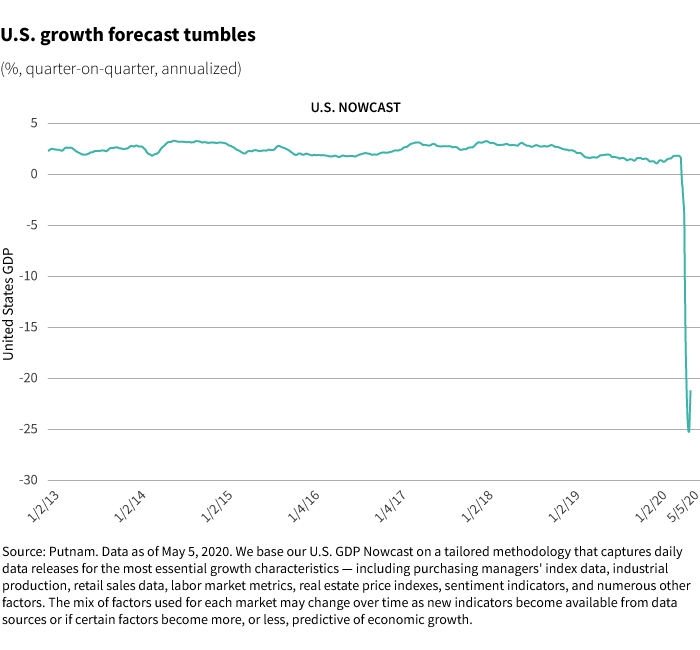

While the U.S. economy is extraordinarily weak right now, the pace of decline is easing. We believe the economy will hit bottom in the second quarter of 2020. Many sectors, including restaurants and air travel, have probably reached the point of maximum pain. The daily mobility data from Apple and Google suggest some improvements in how much people are moving in certain areas — so, as states ease some “stay at home” restrictions, we expect the economy will stop contracting in June.

We believe the economy will hit bottom in the second quarter of 2020.

The recovery in the United States — once it comes — we believe will be slow and halting, and will be punctuated by brief periods of faster growth. There are several reasons for this forecast. The bursts of fast growth are easy to explain; at least some people will react to eased restrictions by going out and spending some money. That will produce some growth, although we doubt it will turn into sustained increases in demand.

The mosaic of states easing restrictions

The relaxation of social distancing measures, which is now taking place or will take place in about 40 states, is not being designed with the efficiency of an economic recovery in mind. In our opinion, the United States is a long way from this sort of efficiency because of legal constraints and the failure of leadership at the federal level. It is little wonder that states felt compelled to develop their own approaches. Relaxations that are driven by political pressures will likely produce less economic benefit with greater health costs. This is the trajectory we believe the United States is on, and it raise two risks, in our opinion.

The first is that relaxations will have to be reversed, limiting the economic gains. The second is that the economic gains will be limited by public apprehension. Opinion polls suggest there is very strong support for retaining “stay at home” until the health risks have more clearly receded. Early, anecdotal evidence from around the country also suggests that demand remains weak. Households, rightly or wrongly, are very concerned about the health risks associated with COVID-19. Many Americans are now in acute financial distress and will take any opportunity to get back into the labor force. Still, we expect the economic bounce from this will be short-lived unless overall demand rises and stays strong.

Looming bankruptcies

We believe the severity of the economic downturn will clearly push many enterprises into bankruptcy. This happens in recessions and, in a typical downturn, the long-term damage is small. When a firm enters bankruptcy, its liabilities get re-priced, the financial losses are absorbed by the asset holders, and there are new owners. The company can get back to its underlying business relatively quickly. What seems different this time around is that the decline in demand has been large enough to affect prospective investment demand and corporate behavior over the long term.

The “stay at home” orders have had a huge impact on travel and tourism. It is clearest in autos and airplanes — two large and high-productivity industries. Car rental companies, which are key customers of auto manufacturers, are suffering as consumer spending declines and used-car prices collapse. With low profitability and the growing threat of rising auto capacity in China, the industry faces a difficult future. Airline companies are also in deep distress worldwide. It’s expected that airplane manufacturing will be weaker for many years as final demand remains a constraint on the companies to which Boeing and Airbus sell. This matters for the macro economy because airplane manufacturing is a large and high-productivity industry.

Personal savings may trend higher

We believe this economic crisis will produce a lasting effect on household behavior. Half of all families approaching retirement had less than $21,000 in retirement savings, and 40% of retirees rely on Social Security (and median Social Security benefits of $17,000 annually), according to data from 2016, most recent available. Older Americans have participated actively in the labor force in recent years. But given the severity of job losses since mid-March, in our opinion, a lot of these people will struggle to find new jobs. The April unemployment rate surged to a record 14.7%, and payrolls dropped by a historic 20.5 million workers. We expect poverty among older Americans will rise as they are too late in their life cycles to do much to increase earnings.

The latest data show that savings rose in the first quarter of this year, but this largely reflects the measurement time frame due to the collapse in activity late in the quarter. According to our forecast, the savings rate will start to trend up on a more stable basis because of the severity of the current shock. Every percentage point of income saved is a percentage point of income that cannot be spent. That matters for the pace of final demand growth as the economy moves beyond the initial phase of stabilization and early recovery.

The rise of the public sector

The rise of the public sector’s importance to the economy is a consequence of the collapse of the private sector. The policy responses have been remarkable. But there is a clear risk of a permanently larger role for the public sector in capital allocation in the economy. The Fed’s interventions in corporate debt markets were designed to minimize its ability to influence credit quality. But the rules for purchasing from firms with a majority of operations in the United States — perfectly understandable from a political perspective — raises efficiency concerns. Washington seems to have decided which sectors to save. Against a backdrop of rising protectionism, we aren’t comfortable with politicians rather than markets deciding an industry’s fate.

There are many in Washington who are calling for the United States to become more independent in the supply of medical equipment. You might be tempted to see medical equipment as strategically important. Surely, food supply is as strategically important as medical equipment, and the United States runs a huge trade surplus in agricultural products. Other countries could attach strategic importance to reducing imports of U.S. agricultural goods. Where would this policy trajectory end? While this is unlikely to have a large impact on prospective growth, we believe it will be negative. Private recovery, which we consider likely to begin in the third quarter, will allow the public sector to shrink back somewhat, but we expect the government will retain a larger role in the economy for a long time.

321754

More in: Macroeconomics,