Effective tax planning means thinking how tax rates might change.

This year is no exception. In fact, the clock is ticking on provisions of the Tax Cuts and Jobs Act (TCJA), which became law late in 2017. Pieces of this legislation, the largest overhaul of the tax code in decades, are scheduled to sunset in 2025 — just two years from now.

Tax policy is subject to change due to shifting political winds. A policy proposal can spark lengthy debate. The forces of inertia and resistance often prevail. Action often stalls amid partisan gridlock — when the two parties control different branches of government — which tends to be more common than unified, one-party control. The TCJA could expire simply because the parties fail to reach agreement on how to extend it.

As such, it seems reasonable to at least plan for the possibility that taxes will be higher in the future.

Impact of the expiring TCJA

The TCJA lowered the tax rates for most income levels. With the built-in sunsetting of the TCJA, the lower tax brackets would expire at the end of 2025 and be replaced with the tax brackets that were in place prior to the TCJA.

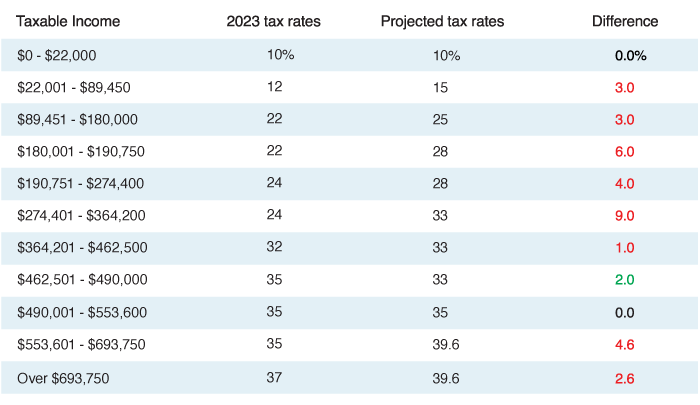

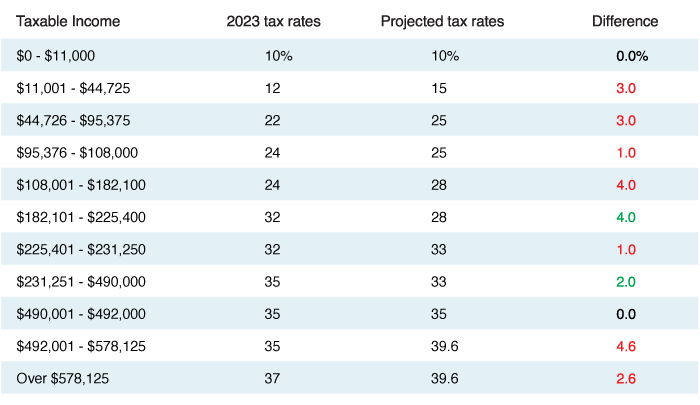

Here is a comparison of how tax rates would differ upon expiration of the TCJA.

Married couples filing a joint return:

Single filers:

*Sources: Internal Revenue Service and Putnam Research. Projected tax rates are estimated and based on analysis of 2017 tax rates prior to passage of the TCJA, with tax bracket figures adjusted to account for annual inflation adjustments through 2023. Figures in red indicate an increase in tax rate upon TCJA expiration. Figures in green indicate where tax rates at certain income levels would decrease upon expiration of the TCJA.

Plan ahead

There are many strategies taxpayers may employ to try to mitigate the impact of higher tax rates in the future. For example, individuals may want to consider diversifying their wealth by the tax status of their assets in retirement.

Tax diversification is a way to strategically plan for taxes in retirement. Creating tax diversification may involve strategies such as converting a traditional IRA to a Roth IRA or utilizing municipal bond funds to generate tax-free income.

Holding assets in accounts that are taxed differently (i.e., taxable, tax-deferred, tax-free) may give savers greater flexibility in managing their tax bill based on their individual circumstances.

More change ahead

The 2024 election will likely impact how the expiration of the TCJA plays out. However, even if one party gains unified control of law making, there is no guarantee that the provisions of the TCJA will simply be extended. The makeup of Congress changes over time, and so do priorities. Leadership may find the price tag of extending current tax cuts too high. The Congressional Budget Office recently forecast the cost of extending individual income tax provisions of the TCJA at over $3 trillion over the next 10 years.

It’s wise to be prepared with a tax strategy that does not depend on current tax rates continuing to be the same long into the future.

More in: Fixed income, Macroeconomics