In the fourth quarter of 2018, U.S. stocks experienced the sharpest drop since 2011. The S&P 500 Index plunged -13.52%, and the MSCI World Index nearly matched that, with a turn of -13.42%. Stocks moved higher again in the first half of 2019, giving investors a second chance to think about whether portfolios are allocating risk appropriately.

Investing in a late-stage market cycle

The current bull market has lasted longer than normal.

Source: Putnam investor education, Bull markets versus Bear markets

By one measure, stocks have been in a bull market for about 90 months — dating to when the market last experienced a downturn for four months or more, which was in 2011.

The average bull market in the post-World War II decades has been 47 months — only about half as long as the current bull.

The economic expansion has lasted longer than most do between recessions

The economic expansion is 10 years old, or 120 months, in June 2019.

The average of all post-World War II expansions is 58.4 months — again, only about half of the current cycle.

How can you stay invested and reduce stock market risk?

Moving in and out of the market can be damaging to long-term performance, but it is considered prudent to periodically review your portfolio’s asset allocation across stocks, bonds, and other asset classes.

Explore diversification across stocks and bonds

Putnam Dynamic Asset Allocation Funds

Conservative FundBalanced FundGrowth Fund

One way to reduce risk is through asset allocation

Bonds are less correlated to the stock market and, historically, have been less volatile than stocks. Stocks and bonds often move in different directions. For example, in the 4Q 2018 downturn, the Bloomberg Barclays U.S. Aggregate Bond Index rose 1.64%, when most stock indexes had negative results.

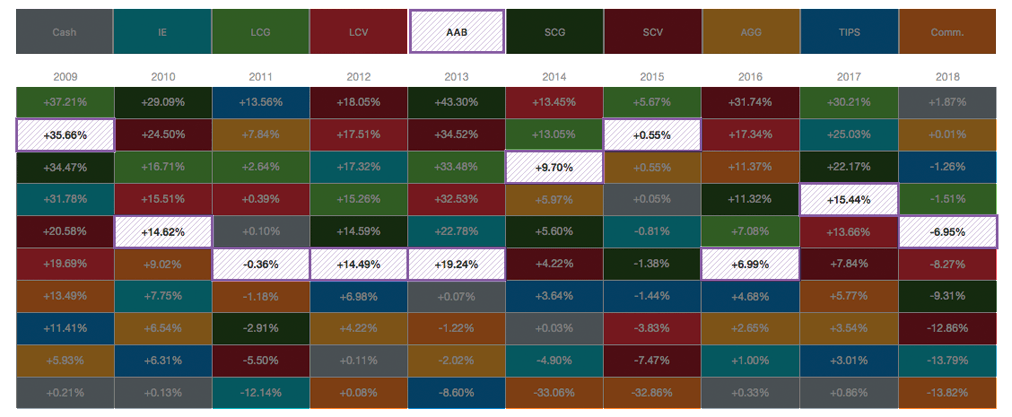

In the case of one diversified portfolio that owned stocks and bonds — Putnam Dynamic Asset Allocation Balanced Fund — you can see that it has never ranked near the bottom in annual performance versus a number of equity styles or versus bonds or commodities

Over the past 10 years, Putnam Dynamic Asset Allocation Balanced Fund avoided market extremes and outperformed several of the weakest asset classes each year.

Go to Putnam.com to trace the performance of individual asset classes.

Help clients set goals and be comfortable with them

For long-term goals, including retirement, it’s important to save and invest consistently and avoid trying to time movements in and out of the market. At the same time, it can be valuable to have flexibility for asset allocation within a predetermined range. After all, it can be challenging to stay invested when the road gets bumpy. A small adjustment in equity risk may help investors feel more comfortable about staying invested. An advisor needs to work with both setting expectations and making investment allocation decisions.

More in: Asset allocation