ECONOMY

- Our 2021 U.S. real Gross Domestic Product (GDP) forecast calls for 6.5% Year-over-Year (YoY)growth.

- We expect the U.S. economy to be stronger and more durable relative to European economies.

- We expect Emerging Market economies to generate the strongest year on year increase in real GDP.

- Our 2021 core personal consumption expenditure (PCE) forecast is 1.87% at year end. We expect inflation data to trend higher in the next few months as we lap easy compares and supply chain issues related to the shutdown.

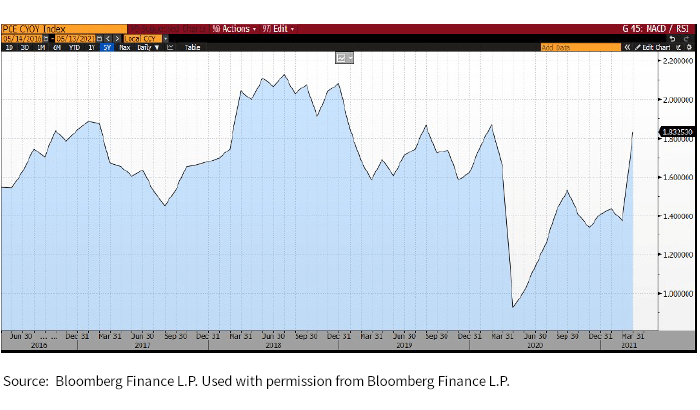

- The chart below shows you the latest core PCE reading of 1.8%:

MARKETS

Equities

- Our S&P 500 target is 4100 at year end. The onus is on earnings to drive prices materially higher from here.

- Putnam’s equity portfolio managers favor the Consumer Discretionary, Industrial / Materials, Technology and Financial sectors. Apart from Technology, these are “early cycle” sectors that we believe should benefit as the economy re-opens.

- We continue to favor U.S. and emerging market exposure. We believe the recent relative weakness in emerging markets (EM) is an opportunity to add exposure.

- We continue to favor value over growth, and small over large, in line with history as the economy reaccelerates.

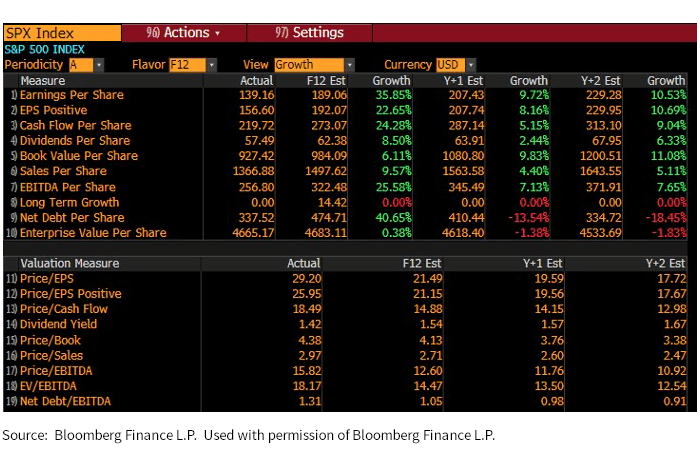

- Earnings estimates for the S&P 500 continue to be revised higher. Three months ago, the consensus estimate for the S&P 500 was $160. Today it stands at $189.06 and reflects 46% YoY growth. See the table below:

- Our primary concerns are centered on S&P 500 valuation and the potential for higher interest rates. The S&P 500 is trading at 21.5x forward earnings today versus the last 70-year median of 17x forward earnings. We believe higher interest rates could limit further multiple expansion.

Fixed Income

- Our 10-year U.S. Treasury yield target is 1.62% at year end.

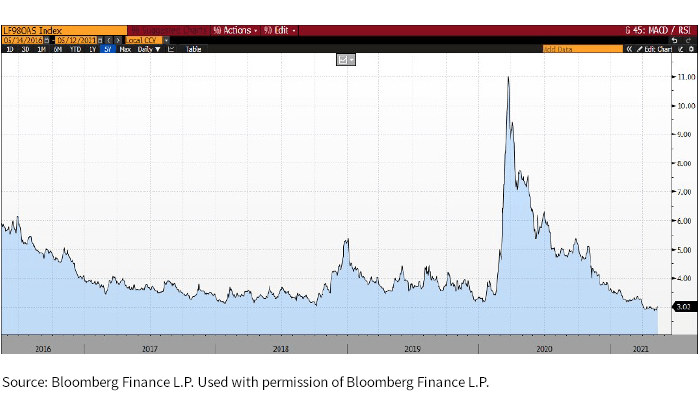

- Putnam’s fixed income portfolio managers are constructive on high yield, investment grade and municipal bonds. However, credit spreads have tightened significantly from March 2020 and may limit total return going forward. See the chart below that shows the Bloomberg Barclays High Yield Index option adjusted spread. Spreads are 295 bps over and are now at the tightest level in 14 years:

- We remain constructive on structured credit and see scope for spread tightening going forward.

RISKS

- Putnam’s investment division generally believes the biggest risks going forward are valuation, and the potential for higher interest rates.

OPPORTUNITIES

- Putnam’s investment division generally believes the biggest areas of opportunity going forward will be found in value, small caps, emerging market equities and structured credit.

The S&P 500 Index is an unmanaged index of common stock performance. This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change. You cannot invest directly in an index.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or limited, as to the results to be obtained therefrom, and to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Bloomberg (BBG) Barclays U.S. Corporate High-Yield Index covers the U.S. dollar-denominated, non-investment-grade, fixed-rate, taxable corporate bond market and includes securities with ratings by Moody’s, Fitch, and S&P of Ba1/BB+/BB+ or below.

All funds involve risk, including the loss of principal. You can lose money by investing.

Past performance is no guarantee of future results.

Not FDIC Insured

May Lose Value

No Bank Guarantee

Request a prospectus, or a summary prospectus if available, from your financial representative or by calling Putnam at 1-800-225-1581. The prospectus includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing.

Putnam Retail Management

100 Federal Street

Boston, MA 02110

326302

More in: Active Insights