Being ready for major retirement risks means considering different options, much as drivers prepare for long road trips.

Safe trips begin with preparation.

Before a recent family trip with three teenage daughters, each of whom had a summer job, we had three family vehicles to prepare. I made sure each car had an up-to-date oil change sticker and clean windows. Imagine my surprise when my effort to check tire air pressure indicated more than half of the twelve tires had dramatically incorrect readings. I was thankful I checked before we pulled out.

There are myriad ways to prepare for a road trip: A popular search engine reveals more than 200 million results for the search, “how to prepare for a road trip.” The checklist from Roadtrippers, suggests checking tires, engine, brakes, lights, wipers, battery, wiper fluid, and motor oil.1 There is a helpful description of what to check for each item. Despite not having run this search before writing this article, I hit many of the things on their list.

What is sequence-of-returns risk?

Some say retirement is the journey of a lifetime. For retirement savers, a close equivalent to what could go wrong on a road trip is sequence-of-returns risk. Forbes Advisor defines it as “the risk that market declines in the early years of retirement, paired with ongoing withdrawals, could significantly reduce the longevity of a portfolio.”2 Simply put, regular withdrawals combined with a market drawdown near the start of retirement could sap the ability of a portfolio to last a retiree’s lifetime.

Since target-date funds make up over $2.8T of the assets in 401(k) plans,3 this category of funds plays a major role in participant outcomes. When a plan is considering target-date options, it is important to understand each manager’s approach to mitigating sequence-of-returns risk in the selection process. Mitigation strategies make a big difference, as Figure 1 illustrates.

Figure 1: Retirees need to consider sequence-of-returns risk after retirement

Source: Putnam Investments.

The chart shows the timing (or sequence) of returns can play a big role in a successful outcome for a retiree. Note that each portfolio experiences the same 11% average annual return. The only difference is the timing of the returns. Unlucky timing causes the retiree to run out of money 15 years into retirement. This scenario would mean a 65-year-old couple could run out of money by age 80.

Understanding and mitigating sequence risk

Because sequence risk has the potential to impact savers and is out of their control, we believe it is a dominant risk that managers should address. That said, the question becomes: What is the best way to address sequence risk?

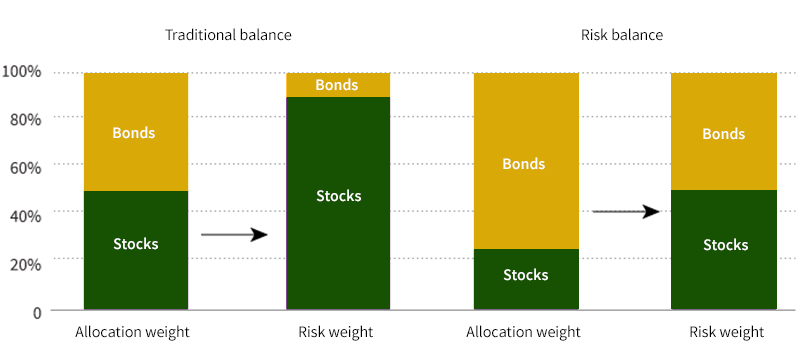

Sequence risk is correlated to portfolio volatility. The higher the volatility of the portfolio, the greater the probability of imposing significant permanent losses. A way to address this correlation is to seek a portfolio with a high risk-adjusted return (Sharpe ratio). Some managers choose to balance allocations by asset, such as balanced stock and bond weightings. But the differences in standard deviation — or risk — between asset classes need to be factored in. A balanced allocation across assets with different standard deviations does not create a risk-balanced portfolio. As Figure 2 illustrates, a significant allocation to bonds, given their inherent lower volatility, may have a significant impact on sequence risk.

Figure 2: Asset allocation differs from risk allocation because of greater risk in equities

Source: Putnam Investments.

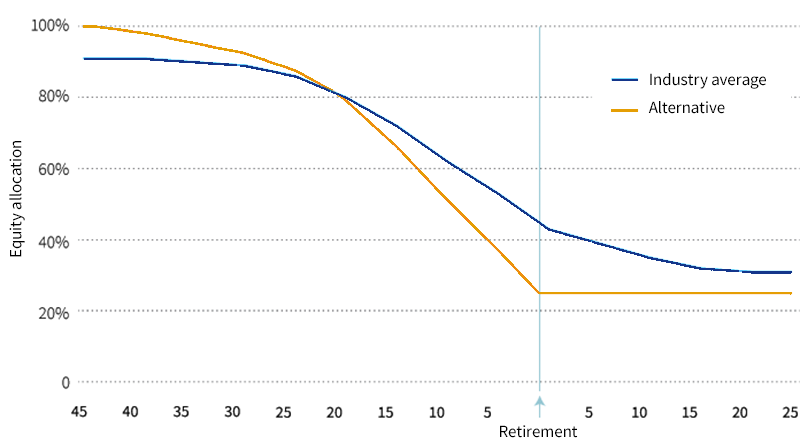

Glide path shape matters

The shape of a target-date glide path may play a key role in its vulnerability to sequence risk. However, there is an inverse relationship between the number of years before retirement and the number of options available to the investor to address an adverse market event. The time it takes to sort through glide paths might leave someone exposed to risk.

As Figure 3 shows, a relatively steep glide path makes it more likely the saver will be closer to a balanced risk allocation if an adverse market event occurs close to retirement. Conversely, being further away from the bond exposure of a risk-balanced portfolio subjects the near-retirement investor to the larger risk associated with a higher equity allocation.

Figure 3:Glide path comparison

Source: Putnam Investments and Morningstar.

Sequence risk impacts all savers

Car problems are just one risk for a road tripper. Similarly, sequence risk is just one of several risks that retirement plan savers face. The others include longevity risk, shortfall risk, and inflation risk. Since sequence risk impacts all retirement savers at a crucial time in their savings journey, though, we submit it deserves the utmost attention of target-date managers.

Retirement plan advisors and plan sponsors are best served by examining the shape of the glide path they are considering to determine how a manager approaches mitigating sequence risk. Putnam’s TargetDateVisualizer® offers a way to see what separates the glide paths of target-date managers. Explore how to use this tool as part of your plan’s selection process.

1 https://roadtrippers.com/magazine/prepare-car-road-trip/

2 Forbes Advisor, “How To Understand Sequence of Returns Risk,” July 6, 2021

3 Morningstar, “Target-Date Strategy Landscape: 2023,” March 28, 2023

Past performance is not a guarantee of future results.

For informational purposes only. Not an investment recommendation.

You cannot directly invest in an index.

333994

More in: Fixed income, Retirement,