Working with a financial advisor is one of the top three drivers of retirement savings success, according to Putnam’s latest Lifetime Income ScoreSM survey. In addition to the benefits of professional advice, the study found that access to a workplace savings plan and deferring at least 10% of income would best position a household for retirement.

Conducted with Brightwork Partners and introduced in 2011, the Lifetime Income Score calculates the income level that households are on course to generate in retirement. The 2013 survey included more than 4,000 working Americans.

Scores represent the percentage of current income the household is likely to replace, including projections for Social Security. Overall, households are on track to save 61% of income. Some households had scores above 100.

Getting professional advice, however, made a significant difference. Households who worked with a paid advisor had a median score of 80, while those who did not had a median score of 56.

Those with an advisor also tended to have higher incomes and greater investable assets. However, when all other key factors were held steady, including household income, investable assets, savings rates, and demographic conditions, simply having an advisor raised the score by 9.6 points.

Those with an advisor also tended to have higher incomes and greater investable assets. However, when all other key factors were held steady, including household income, investable assets, savings rates, and demographic conditions, simply having an advisor raised the score by 9.6 points.

Not surprisingly, having an advisor boosts investor confidence. Households with a paid advisor felt more financially ready for retirement and better aware of how much they need to save for retirement and to cover future health-care expenses than households without an advisor.

Advisors also contributed to confidence about choosing investments in defined-contribution plans. Advised households were more confident about their allocations to stocks, bonds, and cash than households without an advisor.

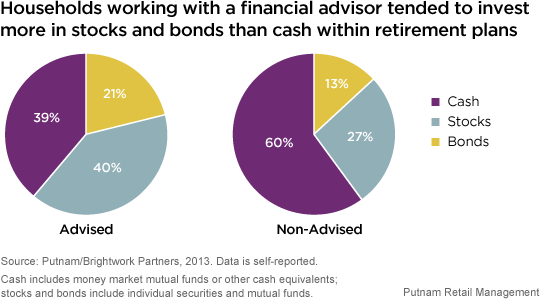

In fact, advised households tended to invest more in stocks and bonds than in cash within retirement plans. Advised households, on average, allocated 39% to cash, 40% to stocks, and 21% to bonds. In contrast, households without an advisor allocated 60% to cash, 27% to stocks, and 13% to bonds.

Advice can have major benefits for investors. Professional advice can help both with the practical strategies for a successful retirement and with providing the confidence that helps investors commit to a long-term plan.

More in: