Over the next 10 years, some of the greatest growth in health-care spending is projected for emerging markets such as China, India, and Brazil. For many reasons, growth opportunities are abundant in developing economies, but selecting health-care stocks, particularly among the smaller-cap companies based in these regions, is not without its challenges.

Growth opportunities abound as wealth increases

In rapidly growing economies, rising wealth and higher levels of disposable income are fueling increasing demand for medical products and services — from the same consumers who are buying more homes, cars, and televisions.

As they grow wealthier, many of these countries are adapting a more western lifestyle, with less physical activity and higher caloric intake. At the same time, many of these countries have much higher levels of tobacco consumption. As a result, we a seeing a large, underserved demand for treating problems such as heart disease, diabetes, and smoking-related ailments.

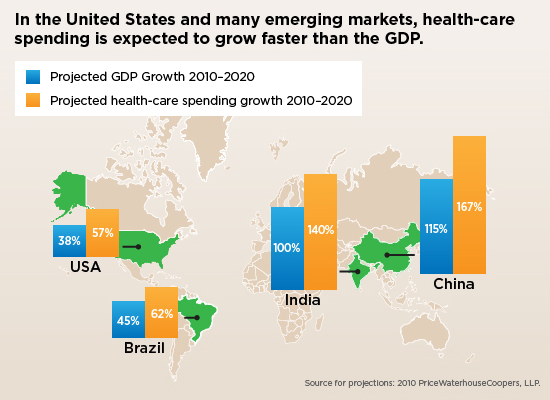

Health care is a vital need, and typically, when people can afford it, they will pay for it. In emerging markets where GDP is projected to grow rapidly, we expect that health-care spending will keep pace with — and in some cases exceed — GDP growth.

One example of the need: Diabetes in China

China provides a great illustration of the growth potential of emerging markets. According to the International Diabetes Federation, as a nation, China has the largest number of people with diabetes — estimated at 92.4 million. At the same time, the IDF estimates that more than 60% of these diabetics are undiagnosed and untreated. There is a clear need for prevention and treatment strategies, and as wealth in China grows, so do the opportunities for companies that provide health-care products and services.

Large multinationals have low exposure to emerging markets

Compared with other industries, health-care companies have relatively low exposure to emerging markets. For comparison, if you look at sales data for leading global consumer goods companies, you’ll find a significant portion of sales — in some cases more than 50% — are from emerging markets. Within the health-care sector, that concentration is much lower. For example, for Sanofi*, a French pharmaceutical giant with one of the highest exposures, emerging markets represented just 30% of the company’s 2010 sales. And most other global health-care companies have significantly less exposure.

What is the best way to capitalize on the opportunity?

For investors, is it better to focus on developed companies with exposure to emerging markets or to invest in companies that are based in these markets? Ideally, a diversified health-care portfolio should hold some of both types of companies, but there are many issues to consider.

The large, established health-care companies offer many advantages. Their larger market capitalizations mean their shares are easier to trade. In addition, most of these companies have solid corporate governance policies and lower regulatory compliance risks. On the other hand, they may have lower growth potential than companies based in emerging markets.

Companies based in emerging markets may offer higher growth potential and in many cases, their valuations are more attractive. However, these stocks pose volatility and liquidity risks, and they can present greater regulatory compliance risks because the health-care industry is not as strictly regulated in these markets. The investable universe of emerging-market health-care companies is relatively new; many publicly traded companies have only been listed in the past five years or so.

Active management, research is key to health-care investing

Within our fund, we seek to own some companies based in emerging markets while also finding established companies that are looking to grow their emerging-markets exposure.

At Putnam, we are fortunate to have a team of dedicated health-care analysts who specialize in a range of subsectors and have expertise in global and domestic markets. Their exhaustive research and collaboration is critical to building a diversified portfolio that can take advantage of opportunities anywhere in global markets.

*As of March 31, 2011, Sanofi represented 2.19% of the fund. Holdings will vary over time.

More in: Equity, Global sector, International, Outlook