We are skeptical about glide paths that seek to reduce risk by shifting the focus of an equity allocation from growth stocks to value stocks. In our analysis, we explore:

- Realized value and growth performance during recent market downturns

- How concentrations in growth or value impact diversification

- Comparing the diversification potential of equity and fixed income sectors

With over a hundred different glide paths available for plan sponsors, it may seem there’s little consensus among target-date managers about the proper glide path — how allocations should change over time. Target-date managers offer different starting and ending allocations as well as paths to get from point A to point B. But there is one guiding principle managers agree on: It is important to reduce investment risk as the participant approaches retirement.

An idea gaining traction recently suggests that reducing risk should not be left to the glide path alone and that adjusting the types of stocks can enhance risk management and mitigation. As the popularity of this “glide-path-within-a-glide-path” narrative grows, it’s time to take a critical look at the investment facts behind it. How does shifting allocations within stocks and bonds affect a target-date strategy’s risk? Below we show that a glide-path-within-a-glide-path does not produce the risk mitigation its proponents seek to achieve.

Realized value and growth performance during recent market downturns

For those managers taking a glide-path-within-a-glide-path approach, the most common shift in exposures, visible in many instances through our TargetDateVisualizer tool, is a shift over time from growth stocks (Russell 1000 Growth Index) to value stocks (Russell 1000 Value Index). The approach reflects a view that the equity allocation over time should skew toward value stocks due to their perceived lower volatility.

Since managers agree risk should be lowered approaching retirement, we find it insightful to compare how growth and value stocks have performed in down markets. After all, large market drawdowns can be particularly painful for participants nearing retirement, when account balances are largest and recovery time is shortest.

Since the Pension Protection Act of 2006 (PPA), which set the stage for explosive growth in target-date funds, there have been nine instances where the S&P 500 Index dropped more than 10%. Interestingly, we find that in seven of the nine instances the Russell 1000 Value underperformed the Russell 1000 Growth.

Evaluating the data objectively, the performance differential is negligible in several of these instances. But even when viewed through the most optimistic lens, it is clear that value offers no advantage over growth in most down markets. Over these recent nine post-PPA instances, value has been far more likely to underperform rather than outperform growth in down markets. Said another way, since target-date strategies have become popular, shifting exposures from growth to value has been more likely to hurt participants than protect participants during market downturns.

Figure 1: Value vs. growth in downturns since PPA enactment

Sources: Putnam Investments, Morningstar 2022. Past performance is not a guarantee of future results.

How concentrations in growth or value impact diversification

Not only does growth tend to outperform during drawdowns, investors also sacrifice diversification by concentrating equity holdings and exposures. Concentrating risk in growth or value means bigger swings for investors, particularly in times of broad market stress. Historically, the difference between growth and value performance has been largest during periods of heightened market risk.

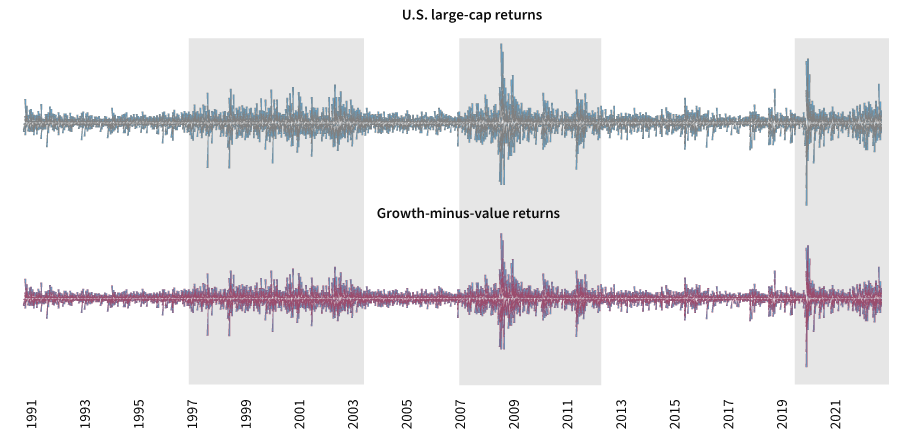

As Figure 2 indicates, when performance of the combined stock universe (U.S. large-cap returns) is experiencing heightened volatility, the spread between growth and value (growth minus value returns) widens out. This can lead to big swings and large performance differentials for strategies that concentrate exposures in one versus the other, particularly when volatility is high.

Figure 2. Growth and value returns diverge more widely when markets turn volatile

Sources: Putnam Investments, Morningstar 2022. Past performance is not a guarantee of future results.

Figure 3 shows that over the past 30+ years, there has been very little difference in the long-term performance of these two equity styles. While there’s greater dispersion between growth and value performance during volatile markets broadly, there is no long-term return premium to be captured by investing in one style or the other — only additional risk.

Figure 3. Growth and value stocks have similar long-term returns

Source: Putnam Investments.

Comparing the diversification potential of equity and fixed income sectors

Finally, it is useful to consider the risk of these equity styles in the context of other asset classes typically found in target-date strategies. If the goal of allocating to value is to reduce risk, the data suggests there are far more effective ways to achieve this than by concentrating stock exposure in value holdings.

In Figure 4, we compare the realized risk of 12 common asset classes over the past 5, 10, and 20 years. The chart illustrates how total risk varies significantly between stocks and bonds. Stock indexes generally experienced volatility 3 to 4 times higher than bond indexes.

But differences in risk within stock and bond categories are relatively small, particularly compared with the difference between stocks and bonds. In fact, over this 20-year window, value stocks (U.S. large-cap value) and growth stocks (U.S. large-cap growth) have experienced almost identical levels of risk. Both styles have higher risk than a diversified mix of the two (U.S. large caps).

Figure 4 makes clear that the goal of reducing risk in a target-date strategy is best accomplished by allocating between stocks and bonds, not between stocks and stocks. Any of the fixed income asset classes, even those with greater risk such as high-yield bonds or emerging market debt, exhibit significantly less risk than equities. A reallocation from stocks to high-yield bonds would reduce risk far more effectively than any reallocation from growth to value.

Figure 4: Fixed income asset classes offer greater risk management potential than equity asset classes

Sources: Risk measured by daily volatility over the relevant calculation window of 5 years, 10 years, and 20 years, each ending 12/31/22. Indexes used (in order above): Russell 1000 Index, Russell 1000 Growth Index, Russell 1000 Value Index, MSCI EAFE Index (USD), MSCI Emerging Markets Index (Net, USD), Bloomberg U.S. Aggregate Bond Index, Bloomberg U.S. Treasury Inflation-Protected Securities Index, JPMorgan Developed High Yield Index, JPMorgan EMBI Global Diversified, Dow Jones Equity REIT, and S&P GSCI Index.

A glide path reduces risk most effectively by shifting from stocks to bonds

Some target-date managers believe in shifting participants’ allocations within types of stocks and bonds as they age — a glide-path-within-a-glide-path approach. Considering the investment case above, it is clear that:

- Based on recent market downturns, shifting from growth to value has meant more pain than protection for participants nearing retirement.

- There is no long-term return advantage for growth or value, and the difference in performance between the styles is largest in volatile markets. This means concentrating risk in growth or value is a bet against diversification.

- Over a variety of time periods, the difference in risk between equity and fixed income is much larger than differences within equity and fixed income styles.

At Putnam, we have long believed, and the investment facts support, that broadly diversified portfolios avoiding style tilts best serve participants of all ages. And we maintain the most effective way to reduce risk approaching retirement is to move from stocks to bonds, not between investment styles within each.

Use TargetDateVisualizer as your TDF evaluation tool today.

334625

More in: Fixed income, Retirement,