- One third of employers offer help to employees paying student loans (Source: EBRI)

- Financial wellness programs are a top employee retention tool, employers believe

- Senators introduced a proposal to permit workers to pay college debt by tapping 401(k)s

Starting a career with a mountain of college debt is a big concern among new graduates deciding how to budget their income. This problem is widespread. Across the economy, student debt has grown to more than $1.5 trillion. While the issue may be making more headlines today, employers have been working to resolve this challenge for many years.

Employers are paying attention

College debt assistance is becoming a more common part of the benefits discussion. A growing number of companies are introducing programs to help employees manage student debt. These programs range from help with debt consolidation or refinancing to loan repayment subsidies paid by the employer.

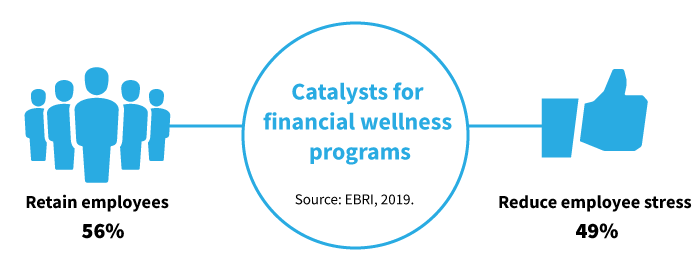

A recent survey by the Employee Benefits Research Institute found:

- One third (32.4%) of employers offer, or plan to offer, a student loan debt program

- 40% of employers have “high” concern about employees’ financial wellbeing

- Employee retention was the number one reason cited by companies that offer student loan debt programs

Congress considers action

Workers may see even more programs emerge if Congress advances a proposal to allow companies to make a “matching” contribution to a 401(k) plan as long as the worker is making a specified minimum payment toward their student debt.

Employers that want to subsidize a student loan payment through a 401(k) matching contribution must pursue approval from the Internal Revenue Service. The process requires a private-letter ruling, given on a case-by-case basis. Abbott Laboratories was the first company to receive approval to use an employer match to help employees paying college debt. (Source: InvestmentNews).

Current law sets limits on linking certain workplace benefits. These restrictions have discouraged many companies from pursuing the loan subsidy.

Federal bill may expand benefits

In April, U.S. Senators Rob Portman (R-OH) and Ben Cardin (D-MD) introduced the Retirement Security and Savings Act of 2019. The bill includes several provisions to improve and expand the existing retirement savings system. A provision in the bill would make it easier for companies to contribute money toward paying employees’ student debt through the company 401(k) plan. The Senate has not yet voted on the bill.

317971

More in: