After nearly a year of the COVID-19 pandemic, what is the financial state of the fifty states? Estimates have swung from great fear to signs that the 2020 health crisis was less harmful than the 2008 financial crisis.

In this series, we take a closer look at individual states.

- California municipal bonds posted positive returns in 2020.

- California was the top issuer among states and municipalities including refunding outstanding municipal debt.

- A small number of states collected higher-than-anticipated tax revenues in 2020.

Did California lose its luster?

A turnaround story of the past decade, California earned budget surpluses, paid down an approximately $40 billion “Wall of Debt” incurred during the fiscal crisis, and amassed a large rainy-day fund under former Governor Jerry Brown.

Early in the COVID-19 pandemic, however, California faced significant challenges. While fighting the worst wildfires in decades and navigating an economic downturn, the state budget moved from surplus to deficit.

In May, California’s finance department estimated that the budget deficit would reach a record high of $54.3 billion during 2021. That total represented more than one third of the general fund.

Yet in June, Governor Gavin Newsom signed a balanced budget for 2020–2021.

State authorities used several strategies to achieve that balance, including rainy-day funds, federal aid in hand, spending cuts, and borrowing. The state had also anticipated more federal aid by October to restore $11 billion in cuts. But the federal government did not come through.

Tax revenues rise

The outlook for FY 2021 is brighter in the near term. California, and a handful of other states, announced that revenue totals were higher than projected.

In light of better-than-expected tax collections, and other budget revisions, California’s Legislative Analyst Office projected a $15.5 billion windfall for the 2021–2022 budget. The windfall is a one-time surplus. The Analysts’ Office expects a small operating deficit beginning in the 2021–2022 fiscal year that is projected to grow to $11.3 billion by 2024–2025.

Borrowing to reduce interest-rate burden

Borrowing has been a key strategy for most states, and California led the way in 2020. Many states refunded older debt to take advantage of rock-bottom interest rates. California was the top issuer (Refinitiv, 2021). Nationally, municipal bond sales increased 11% compared with 2019, before the pandemic. Inflows to municipal bond funds were strong.

Economic recovery has been uneven

California was among the 40 states that saw declines in tax collections from April through September, according to the Urban-Brookings Tax Policy Center. Collectively, state revenues are averaging 5.3% less than a year ago. While lagging, the totals are still better than the double-digit losses anticipated last spring. California’s situation was just a bit below the national average.

California to receive aid for vaccines, schools

In December, Congress passed a $900 billion pandemic relief bill that did not include direct aid to states and municipalities. California did not receive the aid requested. But the bill provides billions of dollars for many programs in the state including unemployment, COVID-19 testing and vaccines, schools, childcare, and transportation.

Governor Newsom also announced a $500 million state-based program to help small businesses and supplement federal loan programs. Small businesses and nonprofits impacted by the pandemic may apply for state grant funds.

Comprehensive research

Governor Newsom sent his 2021–2022 budget proposal to the legislature in January to start negotiations. With uncertainty surrounding federal direct aid to states and municipalities, challenges remain.

Understanding the financial health of states and municipalities is important in muni investing. The municipal bond market continues to offer quality, tax advantages and attractive opportunities. The default rate for municipal bonds continues to be low.

Opportunities in the muni market vary depending on state fiscal situations, making credit research critical to investing. Putnam’s municipal bond experts are looking closely at the budget burdens caused by the COVID-19 pandemic as they compare opportunities in different states.

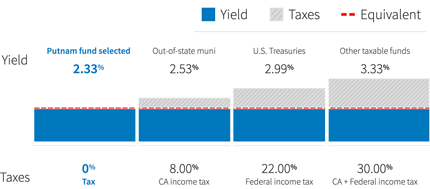

Evaluate yields on a tax-equivalent basis

Compare municipal funds on equal footing with taxable bond funds.

324511

More in: Fixed income