- Average DC plan total savings rates continue to rise, standing at 13.2% as of 2018.

- The current industry average glide path is likely too aggressive given the higher savings rates.

- The goal of a glide path should be to provide adequate income throughout retirement with more predicable outcomes.

A recent study conducted by Fidelity Investments highlighted recent trends and insights across the retirement landscape (“Building Financial Futures: Trends and insights of those saving for retirement across America.”). The data analyzed by Fidelity, as of March 31, 2018, focuses on approximately 22,600 corporate DC plans and 15.8 million participants. Fidelity found that average DC plan total savings rates (i.e., employee + employer contributions combined) have increased to 13.2% in 2018, from 12.7% in 2016, an encouraging statistic. This is a significant development, and asset managers responsible for managing target-date-funds (TDFs) should carefully incorporate this information and how it affects the resulting equity allocation across the glide path.

The impact of savings rates

There are many factors that influence the probability of success for plan participants, but none affects outcomes quite like the savings rate. The importance of savings rates has been well documented by retirement industry leaders. Putnam’s research, summarized in our April 2018 paper, The glide path less traveled, suggests that in order to maintain the same success probability, every 1% decrease in the savings rate necessitates a 10% increase in the equity allocation throughout the entire glide path. Typically, this sobering fact is often used to explain why, for plan participants who save too little, there is no amount of equity allocation that can consistently make up that deficiency. Instead of relying on savings, success will effectively be dependent upon a fortunate series of market returns, akin to a lottery ticket approach. It should be no surprise then that a large component of plan design and participant education focuses on increasing plan savings rates. Fidelity’s data suggest these efforts are having a positive effect.

The implication for target-date fund allocations

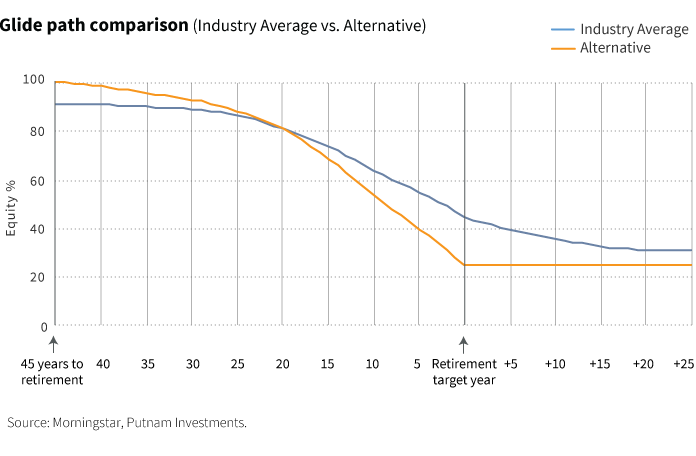

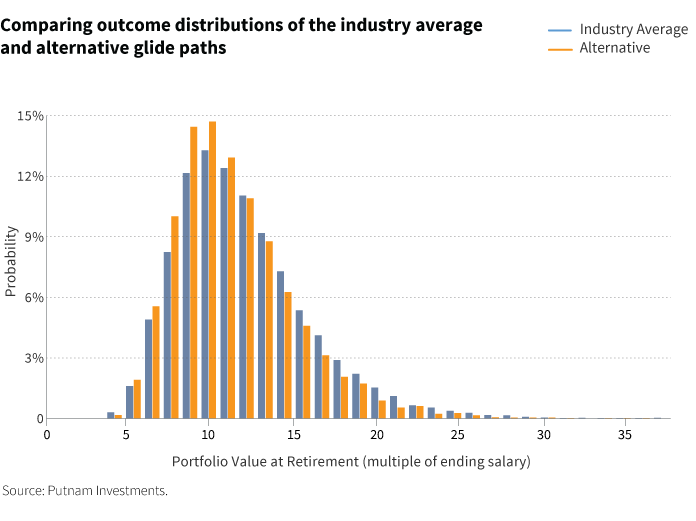

What does this mean for TDF managers in how they allocate to equities across the glide path? If lower savings rates necessitate increases in the equity allocation throughout the glide path, then it is reasonable to suggest that higher savings rates should result in a reduction in equity across the glide path. Even today, using a fairly conservative 10% combined savings rate, Putnam’s analysis suggests that the industry average glide path may be too aggressive for the median plan participant (see chart 1), and that an alternative glide path — one that is slightly more aggressive early on, but much more conservative as one approaches retirement — can lead to more consistent outcomes (see chart 2).

Sustaining savings versus maximizing wealth

An obvious counterargument is that higher savings rates will lead to more fully funded retirement accounts, which in turn, have the ability to bear more risk. That textbook logic is sound if one is purely seeking to maximize ending wealth; however, in our opinion, that should not be the baseline assumption for a TDF manager. The main goal of a TDF should be to provide adequate wealth throughout retirement. In that scenario, retirement success is defined as a participant reaching life expectancy with a non-zero portfolio balance, not maximizing ending wealth. For the greatest likelihood of achieving that goal when designing a glide path, a manager should focus on the central tendency of a given assumption, and then appropriately weigh the costs and benefits of managing the numerous risks facing participants.

The consequence of higher savings

Providing broad access to workplace savings is necessary to begin to solve today’s retirement challenges. Once a participant is enrolled in a plan, increasing his/her savings rate is paramount. If recent savings trends as documented in the Fidelity study persist, it is welcome news; however, it will also necessitate changes in how a TDF manager allocates to equities across the glide path to create successful, predictable outcomes for their participants. For more reasons why this is so, read Putnam’s The glide path less traveled.

313988

More in: Asset allocation, Retirement