IN THIS QUARTER’S EQUITY OUTLOOK – DOWNLOAD PDF

- Several trends could boost equity returns

- Trade negotiations create market risk and active opportunities

- Our strategies in key countries and sectors

In contrast to a year ago, when global markets were enjoying historically low volatility and record highs, investors today are dealing with more challenging conditions. At the midpoint of 2018, markets have advanced only slightly while volatility has increased and investors are less willing to shrug off risks. Following an acceleration in global economic growth last year, we are now seeing slightly less robust growth in Europe, slowing in China, and heightened concern about global trade. In the United States, growth remains strong, due in large part to the Tax Cuts and Jobs Act.

Looking ahead, we believe equities can advance, but they may do so in fits and starts due to inflationary cost pressures and concerns that we are nearing the end of this growth cycle. We believe the likelihood of recession over the next 12 months is fairly low, but we are cautious about emerging markets, particularly those that are vulnerable to central bank tightening due to high levels of debt.

Several trends could boost equity returns

Shep Perkins, CFA

Co-head of Equities,

Portfolio Manager Global core equity strategies

Compared with the past two years, stock market returns have been underwhelming so far in 2018, but several trends could lend support to equities and help performance in the months ahead. The Tax Cuts and Jobs Act plays an important role, providing corporations with additional cash to buy back shares. Additionally, the vast sums raised by private equity investing and robust corporate M&A activity could also contribute to a more attractive supply/demand environment within equity markets.

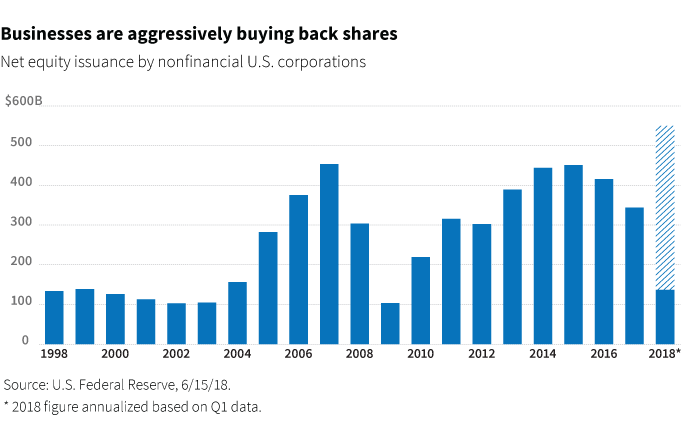

Buybacks are surging

Businesses have been aggressively buying back their own shares for several years. This year is no exception, and tax breaks have provided extra cash to put toward buybacks. Based on guidance from S&P 500 company managements, market observers estimate that buybacks could surpass their record high and top $600 billion in 2018. If completed, this implies a 2.5% return to shareholders on top of the S&P 500’s 1.8% dividend yield, for a combined 4.3% yield.

There is a tendency to assume that an increase in share buybacks means a decrease in capital expenditures. If company leaders are spending cash to pay shareholders, will they hold off on upgrades to facilities and equipment or other growth investments? I believe this is not an either/ or scenario, and strong year-over-year growth in capital spending suggests that companies are investing in their own businesses as well. For the past 15 years, data suggest that U.S. industrial companies have underinvested in capital equipment. Businesses recognize the need to update physical plants and that it is imperative to invest in new technologies to remain competitive.

There’s plenty of dry powder at private equity firms

At private equity firms, high levels of “dry powder” could also play a key role in supporting valuations in the equity market. These firms have raised more than $1 trillion over the past three years, which implies a buying capacity of more than $4 trillion. They are likely eager to pounce on attractively valued companies and take them private.

Corporate M&A activity is robust

Industry consolidation also tightens supply in the equity market. Acquisitions by private equity firms reduce the amount of publicly traded companies, as does robust corporate M&A activity. We believe both trends should continue. M&A is driven by high levels of confidence from management teams with more cash to deploy and a greater urgency to complete deals while interest rates are still relatively low but threatening to move higher.

Larger-scale M&A activity could also surge following the announcement in June that a federal judge approved the merger of AT&T and Time Warner. The U.S. Justice Department had filed a lawsuit to stop the merger late last year, and it also appealed the recent decision. However, we believe this outcome has encouraged more businesses to consider these types of vertical mergers.

Of course, all three of these potential drivers — stock buybacks, private equity investments, and corporate M&A — could be put on hold if consumer or business confidence is shaken by unexpected macroeconomic events or if the economy tips into recession. But at this point in 2018, the environment remains conducive for all three, which should support equity prices, if not fuel further gains.

“At this point in 2018, the environment remains conducive for stock buybacks, private equity investments, and corporate M&A.”

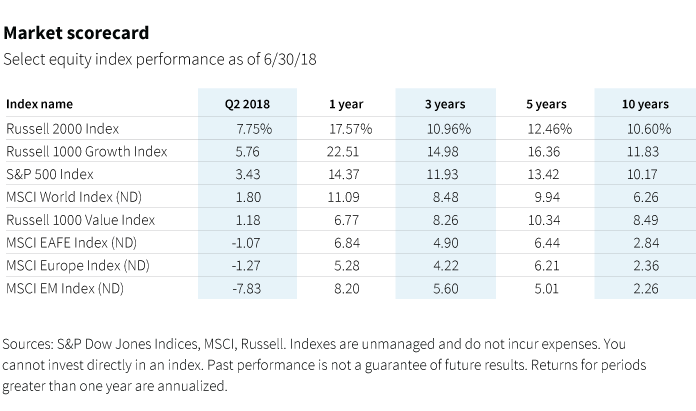

MSCI EAFE Index (ND) is an unmanaged index of equity securities from developed countries in Western Europe, the Far East, and Australasia.

MSCI Emerging Markets Index (ND) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

MSCI Europe Index (ND) is an unmanaged index of Western European equity securities.

MSCI World Index (ND) is an unmanaged index of equity securities from developed countries.

Russell 1000 Growth Index is an unmanaged index of those companies in the large-cap Russell 1000 Index chosen for their growth orientation.

Russell 1000 Value Index is an unmanaged capitalization- weighted index of large-cap stocks chosen for their value orientation.

Russell 2000 Index is an unmanaged index of the smallest 2000 securities in the Russell 3000 Index.

S&P 500 Index is an unmanaged index of common stock performance.

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes.

Russell® is a trademark of Frank Russell Company.

Trade negotiations create market risk and active opportunities

Simon Davis

Co-Head of Equities

Portfolio Manager European core and international core equity strategies

Shep Perkins, CFA

Co-Head of Equities

Portfolio Manager Global core equity strategies

In early July, the Trump administration put into effect tariffs on $34 billion of imports from China, and China has retaliated. This is one piece of the administration’s efforts to revise agreements with major trading partners, including Canada, Mexico, the European Union, and other nations. While only a few tariffs have been implemented thus far — on items like aluminum, steel, solar panels, and washing machines — it seems likely that more are to come. An example is Trump’s proposed 25% tariff on imported autos, which has the potential to be devasting to the profitability of the U.S. and global auto industry.

The impact of tariffs is hard to predict, and there will be unintended consequences. Supply chains have been globalized, so while end products may be made in the United States, sub-components are from all over the globe, with many coming from China and Mexico. Tariffs disrupt this supply chain. As an example, the tariffs on steel have led to such a sharp increase in the U.S. spot price that it is already hurting the profitability of some U.S. manufacturers. And ironically, this higher price is serving to attract more U.S. steel imports.

At the same time, it is important to keep in mind that U.S. GDP is accelerating, as Q2 annualized growth was reported at 4.1%. The 2017 tax reform is having many positive effects for U.S.-based companies as well as overseas suppliers to U.S. companies. Interest rates are still low on a historical basis, even as the Federal Reserve is tightening policy.

Market implications

We believe that trade wars are significant events for global markets and for active investors. The impact of higher tariffs is similar to that of taxes. They make products more expensive, resulting in fewer purchases. They raise prices and reduce demand.

Tariffs will hit corporate earnings and are already starting to do so. For manufacturers, there are more potential losers than winners, as today’s high profit margins are vulnerable to cost increases. Globalization over the past 25 years helped to generally reduce costs, improve margins, and expand markets. Tariffs, on the other hand, are a form of de-globalization and have the opposite effects, namely they raise costs, squeeze profit margins, and shrink markets. In assessing the market impact of tariffs on manufactured goods, it is important to note that manufacturers play a much larger role in the S&P 500 — representing as much as 40% of the index market capitalization — than they play in the overall economy, where they account for just 10% of GDP.

- If the trade conflict worsens, equity prices may drop quickly.

- Higher prices could undermine consumer demand.

- Cross-border trade and investment volumes could decline.

- GDP expectations could begin to decline.

- Business confidence would fall, which would reduce corporate investment.

Risks for U.S. companies in China

The goal of the Trump administration is unclear. It has an established pattern of employing tough rhetoric and policy announcements as a negotiating tactic in an attempt to “capture value” or increase geopolitical leverage more broadly. With China in particular, the objective may be to increase U.S. exports, protect U.S. technology, or make China more pliable on some other matter, such as security issues.

Also, the administration appears to be operating with an incomplete picture of the U.S.-China business relationship. It appears to assume that China will be motivated to meet U.S. demands because of its large trade surplus with the United States — $130 billion in the first six months of 2018 (Reuters). However, that excludes more than $300 billion in sales by U.S. companies operating in China. It also ignores the direct U.S. corporate investments in China, which are more than 3.5 times greater than Chinese companies have invested in the United States. Both China and the United States have much to lose.

The outlook for negotiations

Tariff negotiations will take longer to resolve than anticipated, in our view. President Trump has little incentive to agree to new trade deals before the November mid-term elections. Also, he has harped on the U.S. trade deficit for decades, suggesting he believes in reducing it, even though it has risen since he took office.

With regard to China, at least two of the U.S. demands are difficult for the Chinese government to acknowledge, let alone accept: stopping the theft of U.S. intellectual property and ending subsidies to industries that compete with U.S. companies. We think China’s response to the Trump administration will be guided by the government’s desire to avoid economic instability at all costs. China’s economy is highly levered, and policy makers are trying to gracefully deflate a large debt bubble. An intensified trade spat could derail this strategy and make the economic situation more volatile.

Regarding NAFTA, there may be a better chance that the U.S. reaches a new deal, as it would strengthen the U.S. negotiating position with China, but the odds are still below even, in our view.

Our best case scenario relies less on understanding the administration’s goals than recognizing President Trump’s proven desire to claim victories for the economy and the markets. This may be the path to moderation.

If it appears that the biggest trade threats are close to being enacted, markets could experience sharp price movements. It’s reasonable to expect that President Trump would then direct his trade advisors to settle for a compromise, and call it a victory. In the meantime, the market volatility and greater performance differentiation among equities would create an attractive environment for active investment management.

We expect that China will respond to the Trump administration by targeting U.S. multinationals doing business in China and implementing measures to keep its economy on track.

- U.S. multinationals may face heightened regulatory and tax scrutiny in China, with non-U.S. multinationals ready to seize an advantage.

- U.S. allies, such as Japan, Taiwan, and Korea, may be inadvertently hurt by U.S. tariffs on China exports. This could fuel the transition from a U.S.-centric global economic system to a China-centric one.

- Higher U.S. consumer prices could be another result. U.S. companies, in our view, will not absorb the full cost of higher prices on Chinese goods, and often there are no cheaper alternatives.

- China has already begun to ease its credit tightening measures by cutting banks’ reserve requirements, weakening the currency, and providing liquidity and stimulus in pursuit of its economic growth targets.

Our strategies in key countries and sectors

Simon Davis

Co-Head of Equities, Portfolio Manager

European core and international core equity strategies

Cases of unjustified collateral damage are beginning to appear, in our opinion, changing the opportunities and risks for active managers.

Japan

Japanese industrial and technology stocks have sold down disproportionately when trade war rhetoric increases. This tendency may offer attractive investment opportunities. Japanese stocks appear to weaken due to a combination of perceived exposure to China’s supply

chain, whether the exports are to China or another country, and because the yen typically strengthens when investors are averse to risk. This can act as a headwind to overseas revenue and profit growth for Japanese companies, but in specific cases we think this is unjustified given strong ongoing company fundamentals.

Germany

Germany seems to be a particular target for President Trump on a range of issues, including defense spending, immigration policy, and its current account surplus. As a result, German exports of high-end autos to the United States are a potential target for additional tariffs. This is one of various reasons we generally favor underweight positioning in German auto companies, preferring to get any auto exposure through globally advantaged suppliers.

“Cases of unjustified collateral damage are beginning to appear, changing the opportunities and risks for active managers.”

Daniel Schiff

Portfolio Manager, Analyst

Global Industrials

Industrials

We believe this is manageable for an environment in which global demand is still recovering and capital remains cheap. Specific stocks may garner headlines as a tactic to enhance negotiating leverage with trade partners. The greater risks are the effect on demand through price elasticity (as prices rise, demand falls), decreased cross-border business activity, and the loss of business confidence — a psychological factor that would have a negative impact on investment budgets.

Di Yao

Portfolio Manager, Analyst

Global Technology

Technology

The current tariff list includes only limited consumer electronics products, and we expect it to have little direct earnings impact on global technology companies. However, we are assuming the worst is ahead and are putting a major effort into discounting the impact of further escalation. In a worst-case scenario, where all imported consumer electronics products would be subject to tariff, most of the impact would be on technology hardware companies, which would face both volume and margin risk. Semiconductor companies would also face volume risk.

Putnam Equity Outlook reflects the views of the senior investment leaders supported by the fundamental insights of Putnam’s global equity research analysts. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Emerging-market securities carry illiquidity and volatility risks. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific issuer or industry. Risks associated with derivatives include increased investment exposure (which may be considered leverage) and, in the case of over-the-counter instruments, the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations.

More in: Equity