As described in an earlier post, most U.S. banks now have — or are close to having — the capital they need to meet the federal government’s new capital requirements, we believe. One exception involves institutions that continue to have extensive investment banking operations and still are likely to need to increase capital.

Generally speaking, from this point forward, we anticipate little in the way of new equity issuance. Those banks that need additional capital are likely to attain it by generating and retaining earnings, either as cash or in the form of “safe” securities.

And while the ultimate impact of new financial sector regulations will be unknown for some time, our view is that the risk and volatility of bank earnings, and, by extension, bank stocks, should be lower in the future.

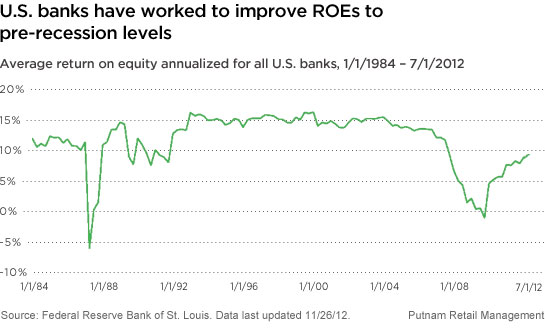

We believe banks have been responding and will continue to respond to the new environment and seek ways to attract investors. As new regulations are implemented, the banks will also explore new ways to protect and increase their profit margins. They are likely to adjust their mix of businesses and develop new ways to work within regulations in order to achieve higher ROEs.

Given that higher capital requirements are likely to lower the profit margins for investment banking, the leaders of each institution will need to decide whether it makes sense to continue operating these units. We anticipate that many institutions will decide to scale back investment banking operations.

Read more in our white paper on the outlook for the financials sector:

Putnam White Paper: The outlook for U.S. and European banks

More in: Equity, Global sector