At its March meeting, the Federal Reserve raised the federal funds rate by 25 basis points. The central bank also indicated that this is likely the start of a tightening cycle, as policymakers attempt to dampen the elevated levels of inflation seen since the start of the pandemic. Markets seem keenly focused on the yield curve in the United States, and whether its potential inversion would be an indicator that a recession is on the horizon. The most common relationship being monitored is the difference between 2-year and 10-year U.S. Treasury yields.

The chart below shows the yield spread between 10-year and 2-year treasuries going back to 1976. The red arrows denote times when the curve inverted, and the shaded areas show recessions as defined by the National Bureau of Economic Research.

Source: Putnam, Federal Reserve Bank of St. Louis

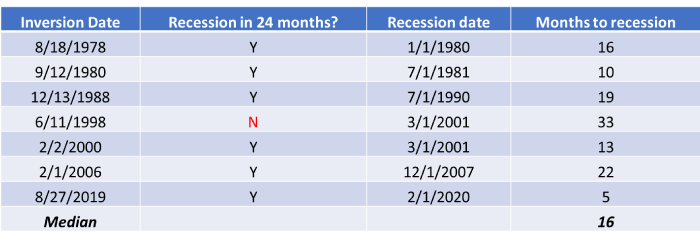

The curve has inverted seven times since 1976. A recession followed within two years of the inversion in six of the seven instances. The median time leading up to a recession was 16 months.

Market performance

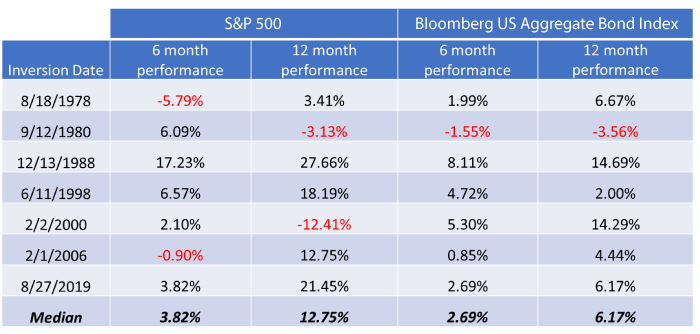

How did markets perform following an inversion? The table below shows the performance of the S&P 500 Index and Bloomberg U.S. Aggregate Bond Index in the 6 months and 12 months following inversion.

Market performance following inversion has been generally positive. The median return for the S&P 500 six months after inversion is 3.82% and 12.75% for the year after inversion. Similarly, bonds have done well with the Bloomberg U.S. Aggregate Bond Index gaining a median of 2.69% in the six months after and 6.17% in the year after inversion.

Source: Putnam, Bloomberg

Alternative measure

The 10-year/2-year yield curve gets considerable media attention but the 10-year/3-month curve has also inverted prior to every recession. While the 10-year/2-year spread has compressed considerably in recent weeks, the 10-year/3-month spread has not inverted. It has steepened, as seen in the chart below, with the spread at 1.8% as of 3/28/2022.

Source: Putnam, Bloomberg

Conclusion

There are seven instances during the past 45 years where the 2-year/10-year yield curve inverted in the United States. In every instance but one, the U.S. economy went into recession within two years, and the median time to the onset of the recession was 16 months. The 10-year/3 month spread is not close to inverting today. However, inversion of the yield curve has hardly been an accurate predictor of future market performance, as the S&P 500 was positive in the 12 months following inversion in 5 out of the 7 instances. Similarly, the Bloomberg U.S. Aggregate Bond Index was also positive in 6 of those same 7 time periods.

The S&P 500® Index is an unmanaged index of common stock performance. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities. You cannot invest directly in an index. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom, and to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom, and to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

329743

More in: Active Insights