ECB easing experiments continue

Currently, the European Central Bank (ECB) is in the midst of enacting a new set of policy measures, backed up with the promise to do more if circumstances require. It is increasingly clear to us, however, that the quality of both the latest measures and of the promises about the future is worth less than we thought a short time ago.

The crux of the debate focuses on the transmission mechanism of the ECB’s version of quantitative easing. The market is struggling to understand exactly how it works, which has created uncertainty, increased volatility, and driven investors into the safety of U.S. assets, particularly Treasuries.

The failure of fiscal constraint

On the fiscal front, the eurozone is constrained by entirely understandable, but misplaced, German enthusiasm for the Stability and Growth Pact, in which EU member states have agreed to enforce fiscal discipline in the wake of the sovereign debt crisis. We think the limits on government spending that this imposes may make sense in a more normal market environment. In such conditions, monetary policy would be able to stabilize demand growth in the face of shocks, and fiscal policy would be directed at longer-term objectives.

However, Europe is currently not in a normal environment. Instead, it is in a zero-nominal bound world, where monetary policy, unable to push rates below zero, is constrained from offsetting the contractionary impulse from fiscal tightening. This condition adds to recession risk: It is now widely accepted by observers outside Germany, and by some economists inside Germany, that the eurozone’s most recent recession was driven by inappropriate fiscal tightening.

Europe puts its faith in a weak euro

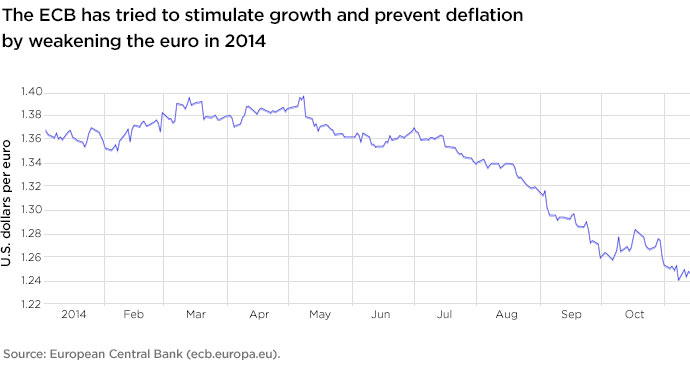

With monetary and fiscal policy constrained by Germany’s stance, this leaves the exchange rate as the pivotal object of European attempts to engineer a recovery. The ECB’s rhetoric has been aimed at weakening the euro because a lower exchange rate will boost the real economy. It will also push up prices, helping to fight deflationary pressures. This is one reason why we feel comfortable with short or underweight euro currency positions across global portfolios, even though the region’s positive current account surplus buttresses the exchange rate.

More narrowly, the ECB hopes to be able to avoid outright quantitative easing by promising enough action to make the euro fall and to generate some inflation. But this indirect mechanism of easing may not be successful, and the markets may force the ECB’s hand. And a central bank that is seen to be slow and at the mercy of market pressures is not one we can be confident will be able to avoid deflation.

Visit putnam.com/advisor for the full Putnam Fixed Income Outlook.

More in: Fixed income