It appears likely that the U.S. economy will continue to improve, keeping interest rates elevated and volatile.

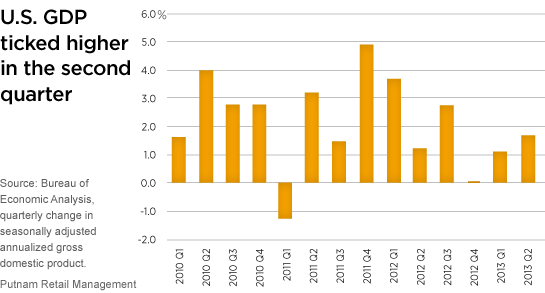

The U.S. recovery, despite higher taxes, generally rising interest rates, and broad-based budget cuts enforced by the federal sequester, appeared to remain on track through the second quarter, and we see the United States maintaining this course in the months ahead. From housing market gains and declining unemployment figures to encouraging manufacturing data and corporate fundamentals, the balance of data was pleasantly surprising through the end of the second quarter of 2013.

This was a welcome change over recent years, where the end of the second quarter saw the onset of a summer slowdown. While the economy initially appeared to be in the process of repeating this pattern in 2013, data improved toward quarter-end. And while this may have contributed to the Fed’s willingness to discuss its processes for evaluating and implementing an end to QE, we think it bodes well for select areas of the fixed-income markets.

Importantly, we expect that the benchmark Barclays U.S. Aggregate Bond Index will continue to be a poor representative of value in the domestic fixed-income marketplace. At an average duration of approximately five years, the index, and strategies that are aligned closely to it, may be overexposed to interest-rate risk. Given the climate of rising rates — and the degree to which rates have shown their ability to back up on fears of the eventual QE withdrawal — we believe term structure risk, which dominates the Aggregate Index, is best avoided in favor of sectors with more attractive risk-and-return profiles.

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities. You cannot invest directly in an index.

283186

More in: Fixed income, Macroeconomics