- Retirement savers are not using target-date funds exactly as designed.

- More than half of 401(k) assets are rolled over into IRAs.

- Investor behavior has implications for optimizing plan design.

In the past decade, investors have poured significant assets into target-date funds. Yet it seems that retirement vintages, when savings should be at maximum levels, have been shrinking as an overall share of target-date assets across the industry.

Favorable features

Introduced in 1990s and strengthened by the Pension Protection Act in 2006, target-date funds have become popular as a one-stop investment vehicle to save for retirement. The funds invest in a mix of bonds and equities that shifts at predetermined intervals to reduce risk leading up to the target date of retirement.

Investor preference for a “set it and forget it” option, along with the use of target-date funds as default options in qualified retirement plans, have fueled the surge in assets. Target-date fund assets totaled $1.1 trillion in 2017, up from $171 billion in 2007 (Investment Company Institute).

The funds for older workers and retirees seem less popular

While it might seem logical that highly paid older workers with years of accumulated savings might cause the retirement vintages to be among the largest, instead these vintages represent a smaller and smaller share. In 2017, about 3.6% of target-date assets were in retirement funds, down from 4.8% in 2012 and 9.3% in 2002. (Ignites).

Different factors at work

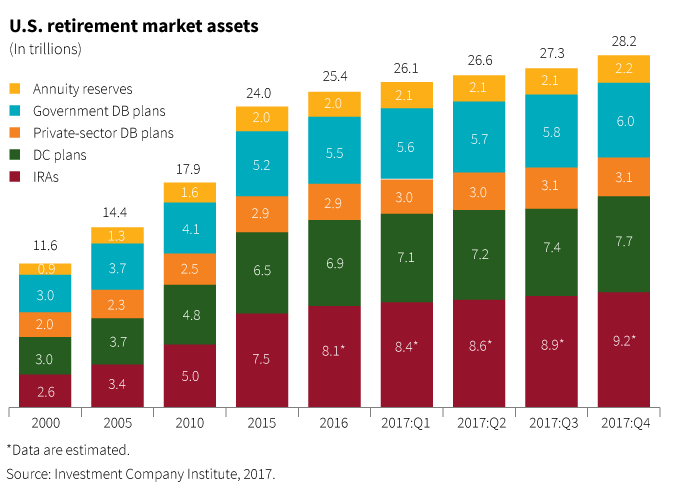

There are several reasons why this could be the case. The popularity of IRAs is one. More than half of 401(k) assets, including target-date assets, are rolled over into individual retirement accounts (IRAs) when workers retire. According to the ICI, IRA assets are the fastest-growing segment of retirement savings.

In addition, the impact of new auto-enrollment features is uneven: Younger workers who joined plans with this feature have assets steered into longer-dated vintages, while older participants who started saving prior to auto enrollment may have previously chosen non-target-date funds. Another possibility is that workers of any age who select funds based on recent performance might favor the vintages that have benefited from strong equity market performance in recent years — in other words, not the retirement vintages.

A signal rather than a risk

In and of itself, the lower asset weighting in retirement vintages does not mean diminished retirement readiness.

However, this observation is important to plan design. If participants do not rely on the retirement vintage to be their source of withdrawals and instead are likely to move that money, it should be conservatively invested with a lower equity allocation.

In other words, how participants behave has implications for optimizing design of the glide path — the predetermined shifts in stock and bond allocations for target-date funds.

Design and education can help participants

Helping participants be ready for retirement involves awareness of how they are using plan features and effective education to help them make prudent choices along the way. At Putnam, we favor thinking about all of the components of a plan together — auto features, investment options, savings contributions, glide path, and manager selection — along with an awareness of likely investor behavior.

311850

More in: