- It’s important for target-date investment managers to recognize that managing the various risks participants face along the glide path requires balancing various trade-offs

- An important consideration is to prioritize the risks participants cannot directly control

- We identify three key considerations for managing sequence risk near and during retirement

A recent Putnam white paper provided a critical examination of various assumptions, outcomes, and glide path specification.* The findings suggest that it is unlikely that any one glide path can perfectly solve all of the challenges a retirement participant faces, and managers must make hard decisions around the costs and benefits of managing the numerous risks facing participants over time. Longevity risk and shortfall risk are often cited as major concerns, though longevity risk affects each participant differently while shortfall risk is often caused by investor behavior, such as inadequate participant saving. Inflation risk is another concern, though its overall impact and the best way to hedge it is another topic of debate. In our view, investment managers should pay special attention to either the risks that participants cannot control, or those risks that will impact the greatest number of participants. Arguably, only one risk checks both of these boxes, “sequence risk” (i.e., the order of market returns). We believe it is the dominant risk that a target-date fund must manage, and balance, accordingly.

The key risk investment managers should address

A retirement portfolio is affected by the timing of returns because it is subject to recurring cash flows and systematic reallocations, which has the potential to be dangerous because it essentially locks in realized losses. Since all participants will face some sequence risk in a traditional glide path that decreases equity allocations through time, the manager must pay special attention to when this risk is greatest for plan participants. In our view, there are three main considerations that an investment manager must take into account while balancing the trade-offs around sequence risk: (1) portfolio size, (2) time horizon, and (3) portfolio volatility.

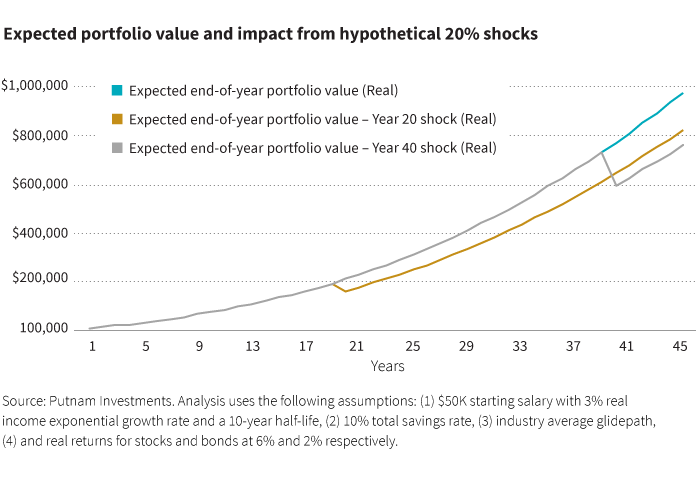

All else equal, the larger the portfolio, the greater impact market returns will have. Using several assumptions outlined in the white paper (Goldstein 2018), Chart 1 plots the expected portfolio values over time for three scenarios: (1) portfolio values absent any negative shock (drawdown), (2) introducing a 20% shock in year 20 of the accumulation phase, and (3) with a 20% shock in year 40. Clearly, a participant who experiences a 20% shock in year 40 is more affected than the participant who has a 20% drawdown in year 20. This effect is further compounded when you consider that there is a strong correlation between portfolio size and investment horizon; portfolio balances are typically at their largest as the investment horizon is small. As Chart 2 shows, with a shorter time horizon, market returns are more variable, with participants having less time to recover if a major drawdown is experienced.

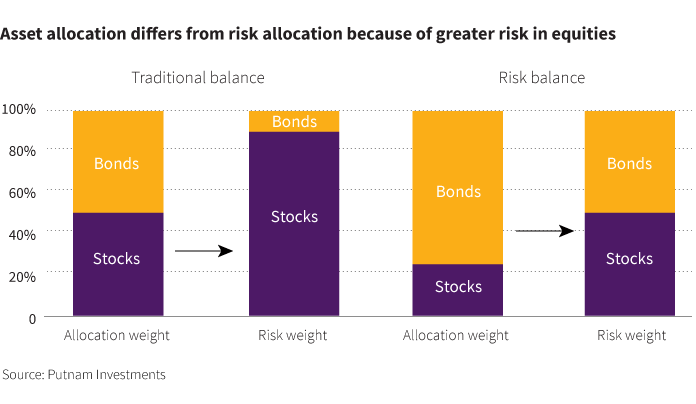

The third consideration is that, all things equal, sequence risk also increases as the volatility of the portfolio increases. The higher the volatility of the portfolio, the greater the probability of imposing significant permanent losses. Portfolio volatility will have the greatest impact in and around a participant’s retirement date. Given that the portfolio still needs to be invested to meet spending needs, but also needs to minimize volatility to combat sequence risk, it is appropriate that the portfolio seek a high risk-adjusted return (e.g., Sharpe ratio). In our view, balancing these needs necessitates a portfolio that has equally balanced risk between stocks and bonds, often referred to as the risk parity portfolio.** As shown in Chart 3, though a 50/50 stock/bond portfolio appears well diversified based on where the assets are allocated, in reality, its risk (volatility) is overly dependent on the equity market. In contrast, a 25/75 stock/bond portfolio is roughly balanced based on risk, and empirical data has shown it to provide attractive risk-adjusted returns over time.

Avoiding a significant drawdown to the retirement portfolio near the retirement date is paramount. When these losses occur in close proximity to retirement, they have the potential to impair the retirement portfolio to such an extent that it may no longer be able to meet the needs of the plan participant throughout retirement. In our next post, we will address questions that guide decisions about the overall shape of the glide path over the 45-year time frame of target-date funds.

* Source: Goldstein, B., “The glide path less traveled,” Putnam Investments, April 2018.

** Source: Schoen, R. “Parity strategies and maximum diversification” 2013.

Consider these risks before investing. Regarding target-date funds generally, each target date vintage has a different date indicating when the fund’s investors expect to retire and begin withdrawing assets from their account, typically at retirement. The dates range from 2020 to 2060 in five-year intervals. The funds are generally weighted more heavily toward more aggressive, higher-risk investments when the target date of the fund is far off, and more conservative, lower-risk investments when the target date of the fund is near. This means that both the risk of your investment and your potential return are reduced as the target date of the particular vintage approaches, although there can be no assurance that any one fund will have less risk or more reward than any other fund. The principal value of the funds is not guaranteed at any time, including the target date.

311945

More in: Retirement