Regarding Japan, we have expressed optimism in recent quarters about the potential economic gains from Prime Minister Abe’s reform program. In 2013, the government and the Bank of Japan unleashed a combination of expansionary policies focused on stimulating economic activity and weakening the yen to give Japanese exporters greater global competitiveness. Results so far have been mixed and, after an initial spurt, the economy has stumbled a bit. Japanese stocks, after leading the world in 2013, fell in the first quarter of 2014.

New tax hike sparks controversy

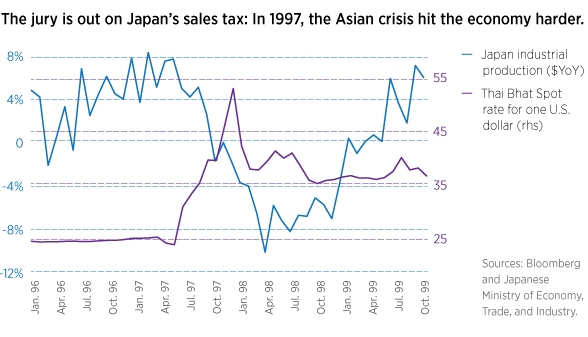

There will soon be fresh evidence to assess the reform program. The latest step — an increase in the rate of the national sales tax from 5% to 8% — went into effect on April 1, 2014. Skeptics believe it will undercut consumer spending and cause an economic tailspin, as in 1997 when the rate last increased. But senior officials within Japan’s Ministry of Finance and the Bank of Japan believe that the impact of the 1997 tax increase has been overestimated. They attribute more of the damage to Japan’s economy to the Asian currency and debt crisis, which broke out at the same time as the tax increase.

Proponents of the current tax hike look to the positive impact it is expected to have on government finances. Japan continues to have the highest national debt in the developed world, and without action, the situation will worsen as the country’s population ages and begins to shrink.

Policy action is possible

We will seek answers in the data soon to emerge, but we are generally disposed to favor Japanese stocks. If the economy performs well, it will make Japan’s debt more sustainable, which would put Japan in solid condition to contribute to global growth. If consumer spending takes a hit because of the sales tax increase, the Bank of Japan may take action. As a result, we are disposed to believe that Japan can join Europe and the United States as an engine of global growth.

288253

More in: International