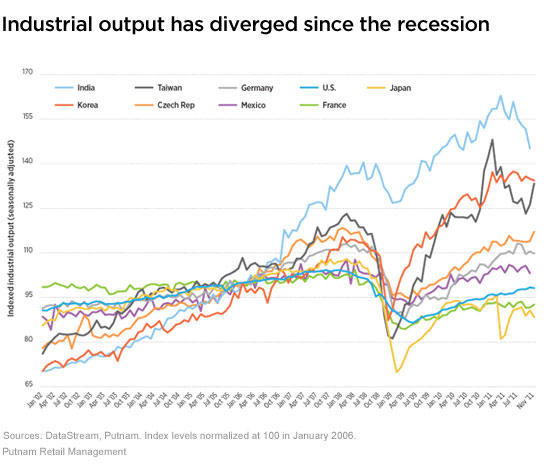

In the years leading up to the global financial crisis, growth across a number of countries was relatively homogenous. That changed in 2008, as nations implemented markedly different policy responses to the recession. Many emerging economies that sidestepped the debt crisis altogether are now damping down rapid growth, while developed economies continue to experiment with a mixture of stimulus and austerity.

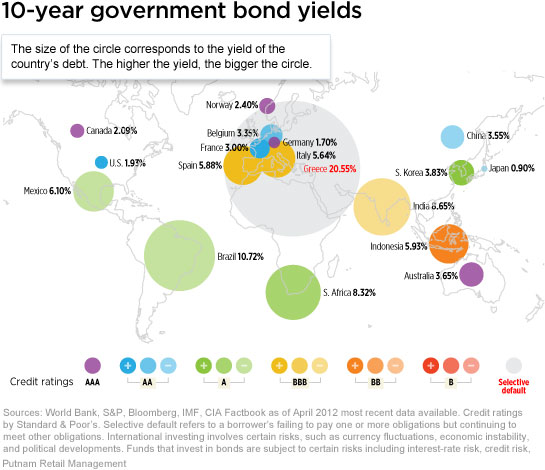

As a result of the disparity in government policy responses, rates around the world have diverged dramatically. The United States’ aggressive stimulus sent interest rates to historic lows and yields in Greece spiked after it restructured its sovereign debt. Today, rates in emerging economies continue to fluctuate as those countries seek a balance between healthy growth and mild inflation. We believe this diverse and volatile landscape represents new opportunities for investors with the capacity for intensive research and active risk management.

Global and international investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk.

More in: Fixed income, International