Given our relatively pessimistic outlook for commodities, we have favored a modest underweight stance for this asset class.

Commodities generally behave with more momentum than reversion, and entered the current quarter coming off a very weak second quarter. Beyond the negative momentum, the weakness in emerging markets represents a very problematic signal for commodities.

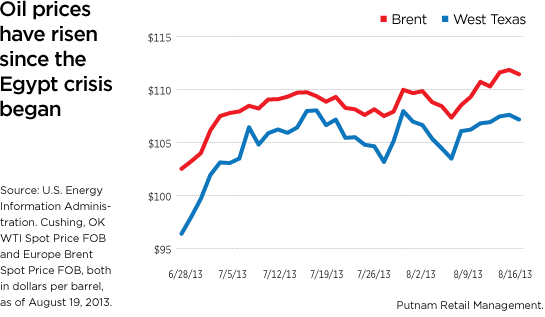

While the outlook might be negative, there are two major sources of upside risk. Geopolitical concerns are at a high point in the Middle East, with political tensions in Egypt and continued strife in Syria. Egypt represents a risk above and beyond the general area’s instability, as any disruption to the Suez Canal has the potential to cause a supply shock for energy markets.

The other source of upside risk for commodities is the continued correlation with equity markets. While they have fallen from recent highs, the strong correlations suggest that commodities could outperform as an asset class in the event of a risk rally.

More in: Asset allocation