- Trade war, the pandemic, and the Made in China 2025 initiative are stimulating new growth opportunities in China.

- Chinese consumers are shifting to favor domestic over international brands.

- Showing new competitiveness in scientific patents, China’s healthcare and technology companies are gaining market share.

As a college student studying economics, I learned the theory of comparative advantage and the benefits of free trade. In theory and reality, free trade increases the availability, quality, and price of good, resulting in higher growth. Overall, tariffs and trade wars create inefficiencies and a deadweight loss for consumers and governments. However, trade policies can also create winning and losing companies within industries. As a result of today’s trade war, we are now eyeing potential new winners in China.

Change in China

China’s economy grew in the 1990s and early 2000s by leveraging its low-cost labor force to become the world’s factory for cheap, low-quality goods. At the same time, Chinese consumers and corporations also viewed international brands to be of higher quality. Both of these trends are changing rapidly today, partly because of U.S.–China geopolitical issues. The trends have accelerated rapidly during the current COVID-19 crisis.

There has been a rapid shift in consumer preferences in favor of domestic brands.

Two clear themes have emerged this year in our conversations with the management teams of Chinese companies. First, there has been a rapid shift in favor of domestic brands. Second, the Made in China 2025 initiative is creating enormous shifts in market share within the technology and healthcare sectors.

Megatrend: China’s rising domestic brands

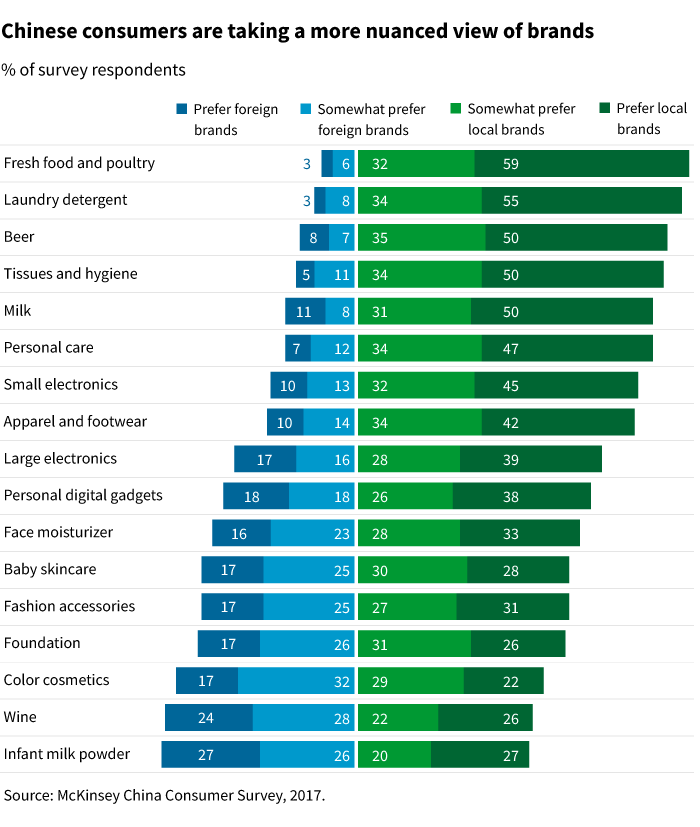

Chinese brands are taking share from international brands across nearly every sector. Our channel checks with management teams suggest that these trends accelerated in the second half of 2019 and the first half of 2020. By comparison, 85% of Chinese consumers preferred international brands to domestic brands in 2011. Today, consumers prefer domestic brands in nearly every category, according to a survey by McKinsey.

We see four main reasons why Chinese consumers are switching to domestic brands:

- Chinese brands have better distribution and understand their consumers better than multinationals.

- Multinationals are slow to respond to changes in social media.

- Value for money: Domestic brands have developed an attractive value proposition versus international peers.

- Patriotism: Consumers want to support local businesses especially amid the COVID-19 crisis and the China-U.S. trade war.

How a cosmetics company seizes opportunity

In large categories such as cosmetics and infant formula, the shift in consumer buying behavior is creating enormous potential growth opportunities for domestic brands. We explored this theme in July when we spoke to the management team of one of our holdings, Proya Cosmetics. Proya generated just $500 million in cosmetics revenue last year. Global leader L’Oreal had $33 billion. However, we believe the Chinese firm has several competitive advantages. First, management is focusing distribution outside of Tier 1 cities where multinationals devote all of their attention.

Second, the company has brought its e-commerce presence in house, unlike the multinationals, which rely on outside vendors for this critical function. As a result, both Proya’s followers and online streaming content across key e-commerce channels are significantly over-indexed versus global peers. Tracking these data points in real time is a way to gain an edge in this undiscovered name, in our view.

Megatrend: Made in China 2025

Made in China 2025, owing to both the trade war and the nation’s historical reliance on international technology, is one of the government’s highest priorities. The goals include increasing domestic-made content of core materials in key industries such as pharmaceuticals, aerospace, and information technology. The target is to nearly double the levels, from 40% in 2020 to 70% in 2025.

The goals of Made in China 2025 include increasing domestic-made content of core materials in key industries.

To pursue this goal, China has invested in developing human capital. China currently graduates more engineers than the United States and earns more international patents. Chinese firms are now producing best-in-class healthcare technology. Local governments are incentivizing hospitals to buy from domestic firms. In May, my colleague Andrew Yoon, and I met with the management team of Mindray, a portfolio holding. Mindray is the leading medical devices business in China. We wanted to better understand how these seismic shifts would impact the growth algorithm of the business.

Specifically, medical devices are a top-10 target for China. The government is mandating 50% market share in hospitals by 2020 with this figure increasing until 2025. We believe Mindray is already a great business with a team of 2,200 engineers and distribution covering 110,000 medical institutions.

Mindray had approximately 10% market share of the more than $1 billion ultrasound market in China. GE Healthcare and Philips dominate this industry globally with over 50% market share. However, we expect their share within China will shrink to less than 10% over the next 10 years, creating what we believe could be an enormous market opportunity for local players.

Research that anticipates earnings

As major spending shifts happen in China, we are using insights from our meetings with company management teams to position our portfolios in companies we consider to be new winners.

As of June 30, 2020, Shenzhen Mindray represented 1.04% of assets in Putnam Emerging Markets Equity strategy. Proya Cosmetics, L’Oreal, GE Healthcare and Philips Heathcare were not held in the strategy, but may have been added at a later date. The companies presented as investment examples represent the securities deemed most relevant to the applicable Made In China initiative being discussed. Investment themes selected based on high conviction ideas and are determined by Putnamʼs Emerging Markets Equity Research team. Current investment themes and investment examples were selected without regard to whether such themes, or relevant securities, were profitable and are intended to help illustrate the investment process. The inclusion of company information should not be interpreted as a recommendation to buy or sell or hold any security. It should not be assumed that investment in the securities mentioned was or will be profitable. Holdings are for a representative account and are shown for illustrative purposes only. Each account is managed individually. Accordingly, account characteristics may vary.

This material is a general communication for informational and educational purposes only. It is not designed to be a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. The material was not prepared, and is not intended, to address the needs, circumstances, and objectives of any specific institution, plan, or individual(s). Putnam is not providing advice in a fiduciary capacity under applicable law in providing this material, which should not be viewed as impartial, because it is provided as part of the general marketing and advertising activities of Putnam, which earns fees when clients select its products and services. The views and strategies described herein may not be suitable for all investors. Prior to making any investment or financial decisions, any recipients of this material should seek individualized advice from their personal financial, legal, tax, and other professional advisors that takes into account all of the particular facts and circumstances of their situation. Representative account data in this report is for illustrative purposes only. Generally, the representative account is selected based on the account that has the longest track record or that is most representative of the intended strategy taking into consideration the account with the least investment restrictions, the size of the account, and/or most relevant and applicable to the prospective client. Representative accounts may change over time. Predictions, opinions, and other information contained in this material are subject to change. Actual results could differ materially from those anticipated. All investments involve risk, and investment recommendations will not always be profitable. Putnam Investments does not guarantee any minimum level of investment performance or the success of any investment strategy. Investing entails risks, including possible loss of principal. Past performance is no guarantee of future results.

322922

More in: International,