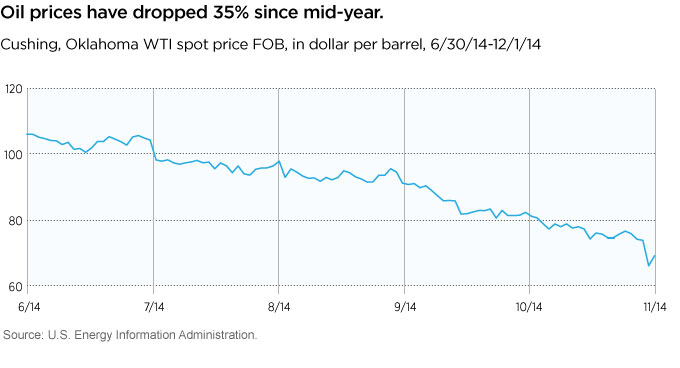

We have a negative outlook for commodity markets in the fourth quarter.

Historically, oil markets have moved up on the news of increased geopolitical tension in the Middle East. However, over the past several months, we have seen the opposite happen. Oil markets have sold off even as headlines highlighted expanding conflict in Syria and Iraq.

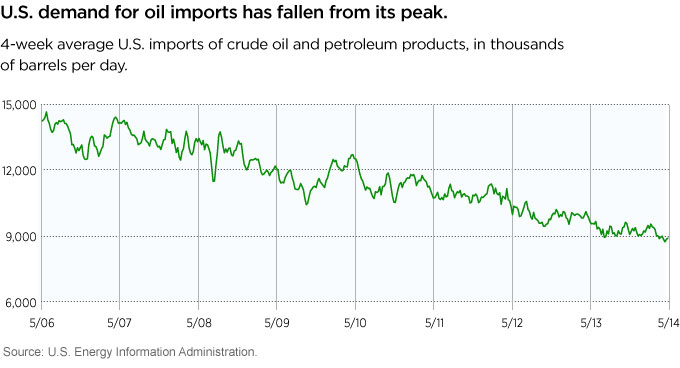

In the face of this tension, three factors — an increasingly energy-independent United States, a stronger dollar, and a weakening Chinese economy — have all served to drive commodity prices even lower. We believe that trend will continue.

With regard to portfolio construction, we continue to a see a decline in the correlation between commodity and equity markets. In the future, this could make commodities an attractive asset class in terms of the diversification benefits for reducing overall portfolio risk.

However, given our current negative outlook for the direction of these markets, we do not believe this is the time to add to commodity allocations.

292260

More in: Asset allocation