- Saving for retirement can be made simpler with target-date funds

- Target-date funds are built with a glide path feature that systematically manages diversification

- When comparing glide paths, risks near the start of retirement merit particular attention

When it comes to saving for retirement, a target-date fund is sometimes labeled as a one-size-fits-all solution. But a closer look reveals that built inside these funds is a careful management approach to multiple investment risks — all with the purpose of keeping savers on path toward a secure retirement.

Looking under the hood

Financial professionals approach retirement as an investment challenge that involves accumulating a certain level of savings by a future date — the target date. It requires first helping to maximize savings growth and then, over time, increasing focus on preservation. The time frame during which this balance must be adjusted is commonly referred to as the “glide path.”

Automatic allocation adjustments

The glide path guides how asset allocations shift over time, as savers progress toward their retirement date. Everyone saving for retirement is on a glide path and hoping for a safe landing, but will nonetheless experience the same ups and downs of stock and bond markets between today and that future date. While it is unknown exactly when markets will be volatile, the glide path takes this into account by reducing risk when it is most important — near and in retirement.

Different managers have different approaches

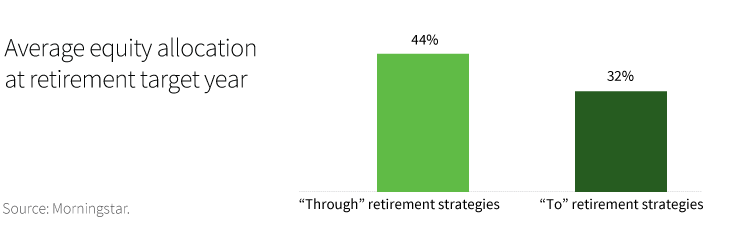

When and how much allocations adjust will vary based on the approach taken by the fund manager. Glide paths can be classified as “through” or “to” strategies. “Through” glide paths are designed for the saver’s working years and retirement years. The glide path continues to adjust after the investor’s retirement date.

A “to” retirement strategy means that asset allocations change until the retirement date. The allocation after the retirement date remains the same.

Opinions differ about whether the “to” or “through” approach is better, but for most savers, the important consideration is to be aware of the different characteristics of these approaches. A “through” strategy typically owns more equities at retirement and may be more volatile. A “to” strategy is likely to have a lower equity allocation at retirement and may be less volatile.

Simple by design

Target-date funds are an important innovation and provide a thoughtful glide path that automatically diversifies retirement savings to reduce risk near retirement. For savers, they offer greater simplicity than building and maintaining a portfolio of many investments over many years. Nevertheless, it remains important to understand some of their design details in order to maximize their potential.

The principal value of the funds are not guaranteed at any time, including at the target date.

308744

More in: Retirement,