- China is among one of the biggest economies to recover from the pandemic-induced downturn.

- Manufacturing is picking up, but services continue to lag among emerging-market countries.

- India and Latin America are seeing rising coronavirus cases.

Emerging-market economies — which were battered during the early part of the COVID-19 pandemic — are slowly regaining their footing. Investors have taken note and are edging back into selected emerging-market equities and bonds. However, against a backdrop of rising COVID-19 cases globally, the recovery has been uneven.

China pulls ahead in pandemic

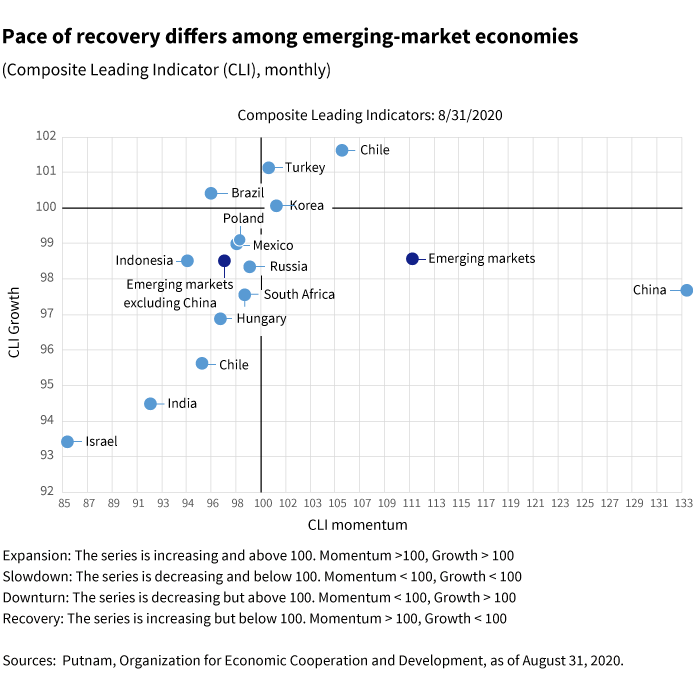

Emerging-market economies continue to improve. The leading economic indicators — such as manufacturing PMIs and new orders to inventories — indicate that a fast recovery may be on the way. The majority of developing countries are in or much closer to the recovery zone, as shown in the chart below. China, Turkey, Brazil, and Chile appear to be the furthest along in their recovery phases.

The pace of recovery has been uneven, however, largely reflecting the same COVID-19 issues as in the advanced world. That means emerging markets don’t move in lockstep with one another. The general global story of a better recovery in manufacturing than in services is also playing out in emerging-market economies. Manufacturing is recovering, and services are lagging.

The pace of recovery has been uneven, however, largely reflecting the same COVID-19 issues as in the advanced world.

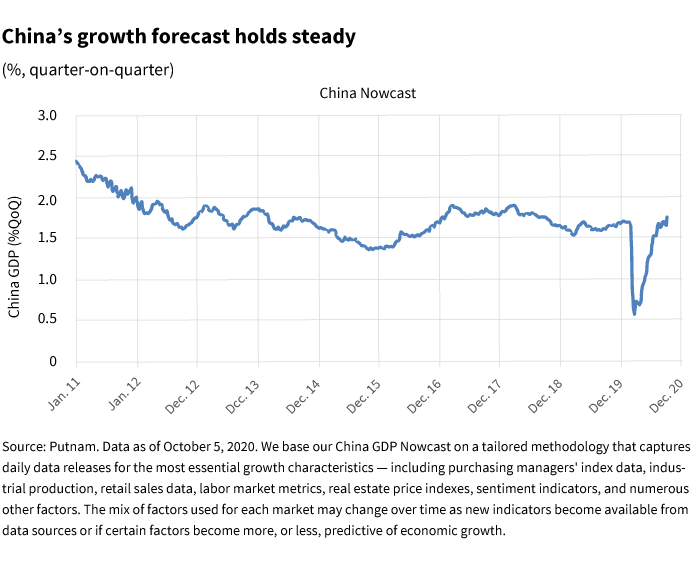

China’s recovery is leading the way. The world’s second-largest economy entered the pandemic in much better fiscal health and got an earlier handle on the virus. Only in China, where stringent health measures have been in place for a long time, have COVID-19 cases retreated by enough to allow for a more complete recovery of the service sector.

The unevenness of the recovery was highlighted in the International Monetary Fund’s latest World Economic Outlook, with China forecast to be the only major economy to expand in 2020. The recovery in China has helped boost its trading partners in parts of Asia and Latin America. Countries with longer and more serious lockdowns, such as India and the Philippines, had deeper growth shocks. Broader OECD indicators also suggest recessionary conditions continue to prevail.

Virus takes toll on India and Latin America

The virus data remain very bad in many parts of the developing world, especially in India, Latin America, and parts of the Middle East. Infections are rippling into every corner of India — a country of some 1.3 billion people — and the rural areas have been hit particularly hard. India, along with Brazil, entered the pandemic with weak economies, limiting their options for dealing with the coronavirus.

Some East European countries are showing the same upswing in infections as in the European Union. From the COVID-19 perspective, the clear outlier is Africa, where younger populations (or perhaps limited test availability) are keeping caseloads comparatively light.

A vaccine, with its positive implications for growth, matters for emerging markets. Still, the intensity of the downturn earlier this year has severely damaged the creditworthiness of some emerging-market countries. Debt sustainability will become a key theme in the post-coronavirus world.

323565

More in: Fixed income, International, Macroeconomics