Billions of dollars will flow to states and municipalities following passage of the American Rescue Plan Act (ARPA). The law provides $350 billion in federal stimulus and should continue to aid the economic recovery.

The ARPA will distribute $195.3 billion in aid across the states and $130.2 billion to local governments. States will receive at least $500 million, with the balance distributed based on unemployment levels. The local aid calculation is based on population, among other factors. The package also includes $30 billion for transit, $130 billion for K–12 schools, and $10 billion for a Coronavirus Capital Projects Fund. The fund is designed to support infrastructure for managing the pandemic. We believe this aid represents a significant percentage of moststates and local government budgets and takes financial pressure off many municipal bond borrowers.

Pandemic hit states differently

Many states are successfully navigating short-term budget shortfalls. On average, states saw a decline in revenue of 0.2% in 2020 compared with 2019 (Tax Foundation). For some states, tax receipts were not as low as projected. The Tax Foundation noted in a recent report that 23 states saw revenue gains in 2020.

Still, the economic recovery has been somewhat uneven. States that rely on certain industries impacted by the pandemic, such as energy and tourism, experienced deeper revenue declines. The Tax Foundation found energy-focused states such as Alaska and North Dakota face more than 20% in revenue losses. States with large tourism industries, like Florida, Hawaii, and Nevada, have losses ranging from 7% to 14%. That said, the combination of rebounding economic growth coupled with the recently passed stimulus bill has us more optimistic on municipal credit fundamentals.

States can utilize aid in various ways to relieve pressure

States can use the ARPA funds for a range of purposes. The provisions allow more flexibility than last year’s CARES Act. The deadline for spending the funds is 2024.

The biggest impact of the aid may be filling more immediate budget shortfalls. Fitch Ratings noted in a recent report that, “The aid is not expected to alter the long-term credit fundamentals of state and local governments, but it should bridge near-term fiscal gaps.”

The aid will likely have a positive impact on state governments with a negative outlook where near term budget gaps are a credit concern. As an example, the outlook for the state of Illinois was recently moved from negative to stable by both Moody’s and S&P ratings services. Another example is Connecticut, which recently received an upgrade from Moody’s to Aa3 from A1, representing the state’s first upgrade in roughly 20 years.

According to the Conference of State Legislatures, states may use the aid to:

- Respond to the Covid-19 emergency and its economic effects, with aid to households, small businesses, nonprofits, and industries

- Provide premium pay to essential employees or grants to their employers

- Provide government services affected by a revenue reduction resulting from Covid-19

- Invest in water, sewer, and broadband infrastructure

Rising home prices often buoys local government tax receipts

Real estate taxes are a significant source of revenue for local municipalities. In some regions, real estate receipts were higher in 2020 due to rising property values.

Record low mortgage rates and inventory levels fueled a steady increase in home prices in 2019 and 2020. The trend accelerated in June 2020.

As for cities, all metro regions tracked by the National Association of Realtors gained. House prices jumped more than 10% in 88% of metro areas in the fourth quarter.

Monitoring credit fundamentals is part of our active approach

Putnam’s active municipal bond investment process closely monitors the financial health of issuers and underlying credit fundamentals as well as market technical and valuations. Putnam’s experienced municipal bond team continuously analyzes credit metrics, the impact of the pandemic as well as other factors, and repositions the portfolios and seeks to capture both tax free income and return opportunities for our shareholders.

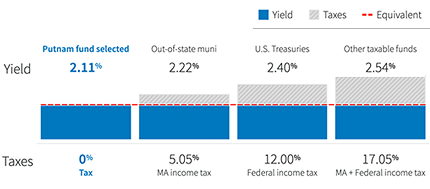

Evaluate yields on a tax-equivalent basis

Compare municipal funds on equal footing with taxable bond funds.

325719

More in: Fixed income