As 2013 begins, we believe the most important question for investment strategy is whether the secular bear market for stocks has ended.

Some evidence suggests it might have. Stock market returns in 2012 were very good, marking the fourth successive calendar year of gains in the United States. Three of the four years delivered double-digit percentage gains. This hardly feels like a bear market.

But do equity market returns since 2008 indicate that the secular bear market quietly transitioned to a bull market, warranting a reversion to 1990s-style buy-and-hold strategies?

We say no.

When the S&P 500 Index first crossed above 1500 in 1999, few investors recognized that for the next 13 years it would spend far more time below that level than above it. Of course, today we all understand that stocks were priced at peak valuations in 1999, reflecting giddy expectations of investors keen to extrapolate the price trends of the late 1990s. Simply put, the past 14 years have seen those lofty expectations gradually replaced by more subdued ones. Consequently, as equity valuations have retreated from their 1999 levels, returns from the stock market have been very low, and volatility has been very high. IN other words, since 1999, we have been experiencing a secular bear market.

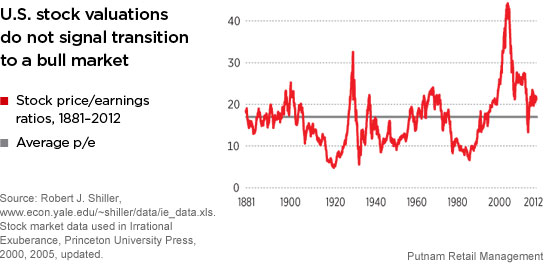

In absolute terms, we see several factors that suggest the secular bear market has not ended. The first is valuation. Without doubt, valuations have improved greatly over the past 14 years. In 1999, the S&P 500 traded at more than 40 times normalized trailing earnings.

Today, that measure has fallen to just over 20 times. While certainly an improvement, even at 20 times trailing earnings, stocks are slightly expensive on an absolute historical basis, because this measure has averaged 17 over the past century, a level that was only briefly breached in 2009. In all of the previous secular bear markets, equity valuations fell to unambiguously cheap levels and remained at those levels for some time. It would be very unusual — though not impossible — for this secular bear market to have ended with only a brief flirtation with the long-term average.

More in: Asset allocation, Equity, Outlook