We evaluate the high-yield market by looking at three key factors: fundamentals, valuation, and “technicals,” or the balance of supply and demand. We are neutral on all three. Looking first at fundamentals, we see an economic landscape marked by countervailing trends. GDP figures in the United States continued to lag past recoveries. Nonetheless, corporate fundamentals still appear to be reasonably solid, although earnings in various early-cycle industries are showing signs of softening. At the same time, the housing market appears to be reviving in many parts of the country, which could provide a nice boost to certain sectors of the economy.

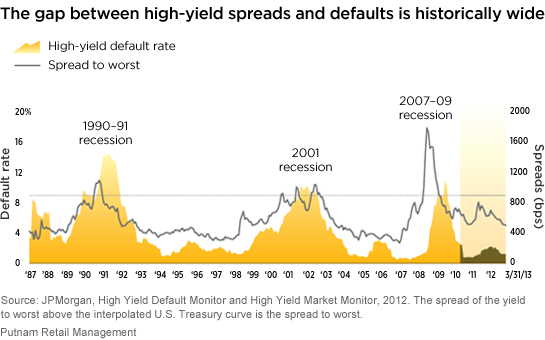

As for valuation, the yield advantage that high-yield bonds offered versus Treasuries has continued to fall. However, we believe the income offered in the high-yield market still appears attractive relative to the other lower-yielding alternatives in other segments of the fixed-income universe.

Looking at market technicals, demand for high-yield issues has been solid in recent months, while new debt issuance in this sector reached record levels, with corporations seeking to lock in attractive long-term rates. These conditions suggest both heightened supply and demand, which leads us to our neutral view of the technical factors in the market.

More in: Fixed income