In 2015, weak global growth, the tightening of U.S. monetary policy, and the appreciation of the dollar all created major headwinds for emerging markets (EM).

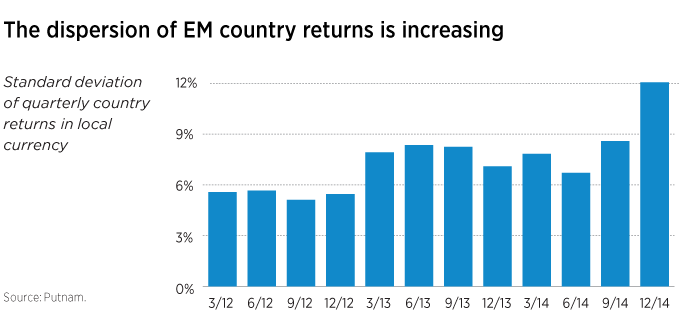

However, we believe all emerging markets should not be lumped together. Recent evidence shows much greater dispersion in the performance of these markets — and this is a new trend.

The dollar does not dominate everywhere

It’s crucial to dispel the myth that U.S. monetary policy is the most important consideration for all EM countries. The EM picture is vastly different today than in the mid- to late-1990s, when nearly all EM countries issued debt in U.S. dollars. Today, many countries issue more local currency debt.

Economic differences abound

Consider the so-called “BRIC” countries — Brazil, Russia, India, and China. A decade ago, market consensus was that these countries advanced in synchronized fashion.

Today, however, vast differences exist —

- Brazil and Russia are major commodity exporters hurt by low oil prices and other raw materials.

- Brazil’s economy is expected to contract 1% this year, while inflation runs at 8%.

- Russia is also dealing with economic sanctions and a decline in the value of the ruble as fallout of the war in Ukraine.

- China, meanwhile, is a massive commodities importer, but is attempting to refashion its growth model to a more domestically driven economy.

- India may offer the most intriguing opportunity, with pro-business government policies and a central bank led by an MIT-trained economist who once worked at the International Monetary Fund.

Despite the headwinds buffeting the asset class in general this year, we believe that select emerging markets offer attractive investment potential for the global investor.

296064

More in: International